What is a Marital Trust?

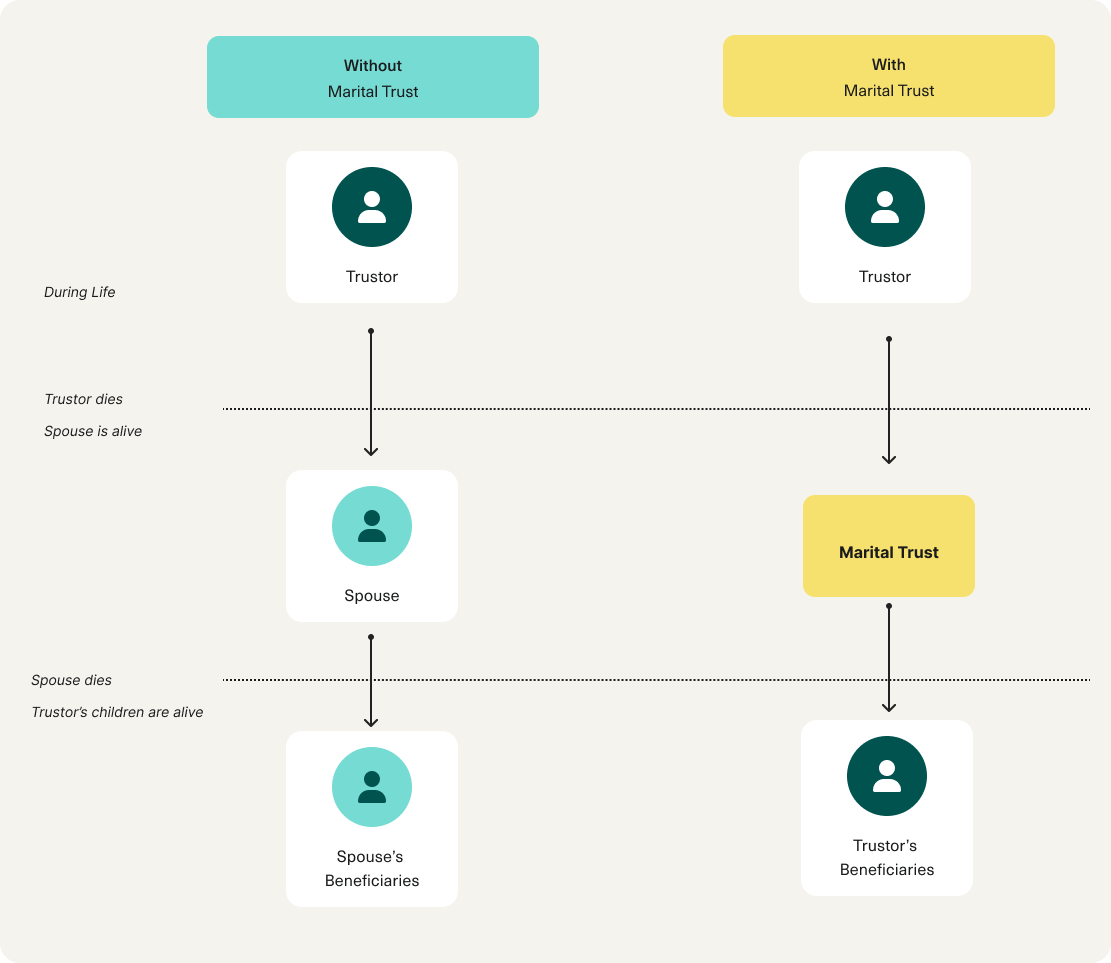

The common name for a trust that benefits the trust creator’s spouse. A sub-trust is a type of trust that is “created under” another Trust (or a “trust within a trust”).

Who Typically Uses a Marital Trust?

- Blended families.

- High net worth families (i.e., estate and generation-skipping transfer taxes).

- Families with assets to be kept within the family (e.g., family business).

A Marital Trust is useful for someone who has children from a previous relationship, worries about someone influencing their spouse to disinherit their beneficiaries, or is wealthy enough to worry about the estate and generation-skipping transfer taxes.

How Does a Marital Trust Work?

They receive a deceased spouse’s assets for the benefit of the surviving spouse. They generally protect assets from creditors while preserving the deceased spouse’s wishes for how their assets will be distributed and used, including at the surviving spouse’s death. When properly structured for tax planning purposes, they can preserve the deceased spouse’s generation-skipping transfer tax exemption amount without jeopardizing the unlimited marital deduction.

5 Key Features of the wealth.com Marital Trust

There are many ways to design a Marital Trust. If you want your spouse’s inheritance to qualify for a benefit called the “unlimited marital deduction” (i.e., passing an unlimited amount of property at your death to your spouse completely free of estate tax and without using your estate tax exemption), the Tax Code has stringent requirements for the design of this Trust. The Trust must qualify as a “qualified terminable interest property” (or QTIP) Trust. The wealth.com Marital Trust is this type of Trust.

- Only your spouse can be the beneficiary of the Marital Trust.

- The Trustee must distribute any “income” generated inside the Marital Trust (e.g., rent if the Marital Trust owns a rental unit) at least once a year, but can do so more frequently if desired.

- The Trustee can make distributions for your spouse’s health, education, maintenance, or support. If the distribution is for any other reason, an independent trustee (who cannot be your spouse) should be appointed to provide checks and balances.

- You can choose whether your spouse may serve as trustee. If you are concerned about your spouse serving as trustee (e.g., because your spouse will be unable to manage the inherited assets or you would like checks and balances on your spouse’s ability to spend the inheritance), you will be able to prohibit your spouse from serving as the trustee and appoint someone else as the trustee.

- You can always change your mind about including the Marital Trust. This flexibility is built into the wealth.com platform for maximum personalization as your life circumstances change.

Download A Printable Version of this Marital Trust Guide

Download PDF*Disclaimer: wealth.com is not a law firm and is not practicing law. That said, our platform is maintained with care by attorneys who used to practice at the top trust & estate law firms in the U.S. so you can be sure each legal document created with Wealth.com is of the highest quality and is legally valid and optimized for its state, covering all 50 of the United States and Washington D.C.