What’s the Difference and Which One Is Right for Me?

TL/DR: In simple terms, a Will is a legal instruction to the court about what should happen to what you own after you have passed away. A Trust is a contract you make with someone whom you trust about what you own, regardless of whether you have passed away. There are many types of Trusts, but the Revocable Trust (or Living Trust) is most commonly used as a substitute for a Will. The Revocable Trust may offer you some advantages that a Will doesn’t, as this article will explain.

_______________________________________________________________

In climactic movie scenes and music videos when a family gathers to hear how the dead person’s fortune will be split up, it’s always the deceased’s Will being read out loud for the big reveal. In real life, however, a Will doesn’t get read out loud; instead, the executor sends a copy to all known beneficiaries.

Even without a dramatic reading, you might still have concerns about keeping your last wishes private. A Will becomes a publicly available document on the probate court’s docket. Probate is often how the press learns the details of a celebrity’s assets and who the heirs are after the celebrity has died.

If maintaining your privacy is important to you, consider making a Trust – and not a Will – the centerpiece of your estate plan.

A Revocable Trust (or Living Trust)* can be a great alternative for many reasons, beyond privacy. These fall into four main categories:

- Avoiding the court process at death

- Keeping your wishes private

- Planning for your incapacity

- Learning a new set of words

Note that just because most Americans have a Will* and not a Trust does not mean that you should have a Will. Depending on your situation and wishes, a Revocable Trust may be the best option for you.

If, after we dig deeper into each of the differences, you’re still not sure, take our quiz here.

_____

*1 The rest of this article may refer to this type of Trust as simply “Trust.” A Revocable Trust (or Living Trust) is not to be confused with an Irrevocable Trust. Learn more about this topic here.

*2 A lot more people have a will (60% of the people we surveyed in our estate-planning research who have an estate plan) vs. a trust (38% have a living or revocable trust, and just 19% have an irrevocable trust).

Avoiding the Court Process at Death

The main reason people choose a Trust is to simplify the court process that happens at death, which is called “probate.” If you die with a Will that distributes your assets (or without an estate plan at all), a probate judge will oversee how your assets will be distributed.

This process can be difficult and expensive and take a long time. If one or more factors indicate that probate will be more onerous for your estate, you should consider putting in place a Trust to avoid probate. These factors are:

(a) You live in a state that tends to have a complicated or expensive probate process.

(b) You own real estate (or tangible objects of significant value) that is located in a state other than your home state.

(c) You own assets that are complex and may require more active court supervision, like stock that is not publicly traded.

Unpacking each of these factors:

(A) Some states charge probate or court fees based on the size of your estate (i.e., how much you owned in your name at death). Attorneys may charge up to tens of thousands of dollars to help your executor navigate probate. All those fees are first paid from your assets, so there will be less left to distribute among your loved ones. And even when your assets are not particularly complex, probate in your home state could tie up your assets for up to two years. If you live in a state like this, a revocable trust will allow you to put more control in the hands of your trustee and “bypass” much of the probate process.

(B) If you own real estate or personal property in another state, dying with only a Will means that your executor must start probate processes not only in your home state, but in all the other states as well. By putting the property located in other states in your revocable trust,* your trustee will be able to avoid these “offshoot” probate proceedings.

(C) If you own assets that are a little more complex, such as stock that is not publicly traded, your executor will have to coordinate more closely with the probate court to make sure the stock is properly transferred to the appropriate beneficiaries. This can lengthen the time for probate.

If you anticipate that probate would be costly and time-consuming for your loved ones, a Revocable Trust might be the best option for you.

____

*If you place the real estate or personal property in an entity like a limited liability company (LLC), you may also be able to avoid probate, but that analysis must be done by an attorney licensed to practice law in the state where your real estate or personal property is located.

Keeping Your Wishes Private

As part of the probate process, a Will becomes part of the public record. Revocable Trusts typically avoid probate (unless there is an issue like an angry family member who brings a legal claim against your Trust). With a Revocable Trust, your estate plan is more likely to remain private.

Information that will become public if part of your Will include:

(a) Who you consider to be your family members.

(b) Who you want to exclude from receiving your assets or having a trusted role in your estate plan.

(c) Who will receive your assets, and how much of your assets they will receive.

(d) How you would like your last remains to be handled.

If you would prefer to keep these details private, a Revocable Trust might be the best option for you.

When They Become Effective

A Will does not become effective until you die, whereas a Trust is effective immediately on the day you create it. As a result, a trust has legal effect before your death – i.e., while you are alive but either incapacitated or unavailable. If it is important for you that someone take over responsibility for your financial affairs immediately if something were to happen to you, then a Revocable Trust gives you a more powerful vehicle compared to a Will or a financial power of attorney.

Ensuring that “it’s business as usual,” can be especially important if you own a closely-held business and you are expected to be involved in the day-to-day operations or in making high-level decisions by voting your shares. Your succession planning for your business should include transferring your shares into a Trust so that your trustee can step into your shoes if something happens to you.

Learning a New Set of Words

A Trust can be used as an alternative to a Will, but the vocabulary will be different and less familiar to most people, which contributes to the feeling that Trusts are more complicated than Wills. For example, instead of referring to an “executor” or “personal representative,” the trusted individual who will manage your affairs is called a “trustee.”

That being said, if there are factors indicating that you should have a Revocable Trust, you should not let legal terms discourage you from using a Trust as the centerpiece of your estate plan.

What Are Common Misconceptions about What a Trust Can Do For Me That a Will Can’t?

1. If you have a Revocable Trust, you won’t need a Will.

Even if you have a Revocable Trust, you will still need a Will. If you pass away with any assets in your own name, you need a Will to make sure all of those assets go into your Trust, where the Trust will instruct where those assets will go. This type of Will, which accompanies a Revocable Trust, is much shorter than a standalone Will and is commonly known as a “pour-over Will.” This is important because some assets must be owned in your own name while you’re alive, like a retirement account, and you may not get around to putting all your assets in the name of your Trust before you pass away.

You will also need a pour-over Will to name an executor and guardian(s) for your children, if any.

2. As long as I have a Revocable Trust, my loved ones will definitely avoid probate.

A Will must go through probate, whereas a Revocable Trust has the opportunity to avoid probate.

First, you will need to “fund” your Trust, which means transferring as much of your assets as possible into your Revocable Trust. Some courts, like in California, may allow you to avoid a full-blown probate if you show that you intended to fund your trust by signing a general assignment of all your assets into the trust. Other states will instead require that you actually re-title any real estate and change the owner on your bank accounts and other assets.

Lastly, the probate court may become involved to resolve any issues among your beneficiaries or trustees. For example, someone may call into question whether your Will and Trust are not valid.

3. A Revocable Trust will make it harder for someone to sue my estate.

We all fear that someone will be unhappy with the wishes of the decedent or how the estate administration is being handled and bring a lawsuit against the estate. Having a Revocable Trust instead of a Will will not deter a motivated person from suing against your assets at your death.*

Note that a Revocable Trust should not be confused with an Irrevocable Trust, which may offer some level of asset protection. Asset protection means that a creditor (for example, someone to whom the Trust beneficiary owes money for an accident) may not be able to reach the Trust assets because the assets are considered to be separate from the beneficiary and cannot be used to fulfill the beneficiary’s debt.

4. If I anticipate that my estate will owe death taxes, I must have a Revocable Trust.

Tax planning for estate and generation-skipping transfer taxes can be accomplished with either a Will or a Revocable Trust as the centerpiece of your estate plan. You do not need a Revocable Trust just because you may have a death tax issue. The important thing is to make sure your Will or Trust has the proper provisions to meet your tax planning goals. Your Will or Trust must create Trusts after you’ve passed away (a testamentary sub-Trust) that comply with the Tax Code and direct your assets into those sub-Trusts using rules or formulas that will minimize taxes in the long term.

Sub-Trusts are Irrevocable Trusts created at your death and are not to be confused with Revocable Trusts that you create while you are alive as an alternative to writing a Will.

5. If I would like more control over how my assets are used after my death or keeping my assets within my family across generations, I must have a Revocable Trust.

If you would like to maintain some control over how your assets are used or gifted away after your death, you should make sure sub-Trusts (see 4 above) are created after your death. To create this type of sub-Trust, you can use either a Will or a Revocable Trust as the centerpiece of your estate plan.

Sub-Trusts are Irrevocable Trusts created at your death and are not to be confused with Revocable Trusts that you create while you are alive as an alternative to writing a Will.

____

*Certain estate planning tools exist to deter someone from suing your assets, including “no contest” or “in terrorem” clauses. These tools can be implemented in a Will or a Trust with the advice of an attorney.

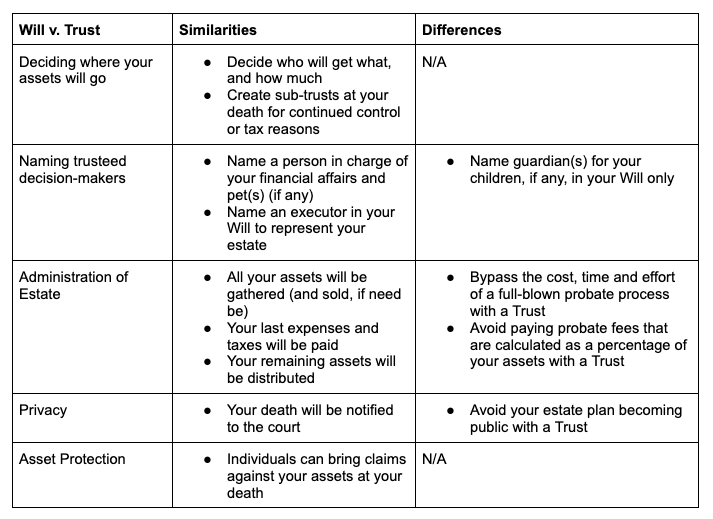

The chart below summarizes the overlap and differences between a Will and a Revocable Trust in most U.S. states.