To continually deliver quality and value to our members, we take a proactive approach to product innovation. This update highlights features from the month of April. We welcome any feedback or questions: [email protected]

New Feature Spotlight

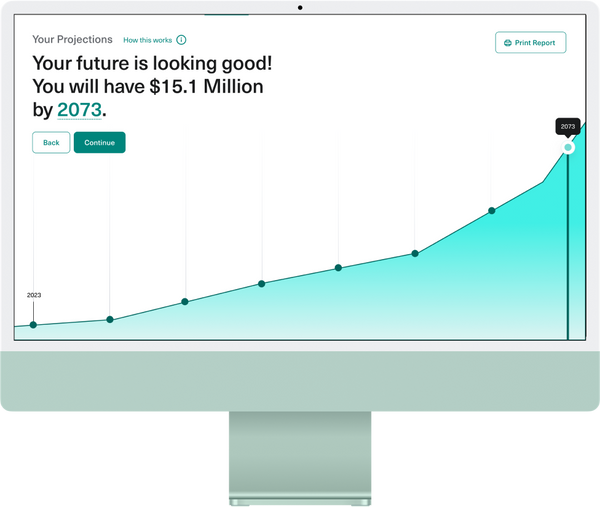

Our Wealth Projections Calculator is now live. Going beyond comprehensive net worth calculations, our machine-learning-based model projects a member’s future net worth, the potential impact of federal estate taxes on their taxable estate, and what their beneficiaries may receive based on these insights. Designed by the SVP of Machine Learning, the former Head of Data Science and Machine Learning at Vanguard, our proprietary machine learning model uses specific asset types to provide realistic projections, relying on 20+ years of economic data customized specifically to capture signals that might impact a member’s net worth.

- We further customized our document creation workflows to accommodate members who are in long-term, but not legally-recognized relationships, so that they can better document their wishes to include their long-term partner. This includes an analysis of how this relationship status impacts tax and estate planning based on federal laws.

- Revocable Trust and Last Will & Testament documents now allow members to choose to redistribute a deceased beneficiary’s shares among other chosen beneficiaries, or to instead pass the shares to the deceased beneficiary’s descendants.

- In order to help create legally sound and accurate documents, we enhanced our document creation workflow to guide members to sections of their drafting that may warrant an additional review.

For Financial Advisors

- Our advisor partners and their relationships with their clients are extremely important to us. We updated our onboarding experience to improve clarity on the relationship between the client and advisor, highlighting that the platform does not enable the advisor to provide legal advice to the client.

- To improve efficiency and streamline onboarding, we added flexibility to the client invitation process for advisors by enabling the ability to copy a link to invite their clients to join Wealth.

- With recent banking volatility, highlighted by Silicon Valley Bank falling under FDIC receivership, asset protection is top of mind for advisors’ clients. In response, we released new content for advisors to leverage in conversations with their clients, including how effective estate planning can be used as a tool for asset protection and FDIC coverage.

Additional Updates

The onboarding experience was updated to reflect more specific details, including if a member has children and/or already has an estate plan, to provide more personalized experiences in app and smarter auto-completion within the document creation workflows.

We want to hear from you. Please share your feedback with us!