As we close out 2024, we’re excited to share the latest product innovations for advisors to leverage in the coming year oversee their clients’ estate plan creation and management. These new releases—from major AI enhancements to increased collaboration functions—are designed to enable advisors to streamline the estate planning process to optimize for efficiency to drive client satisfaction.

Generate easy-to-read summaries with Ester™ AI, including expansion to support Irrevocable Trusts

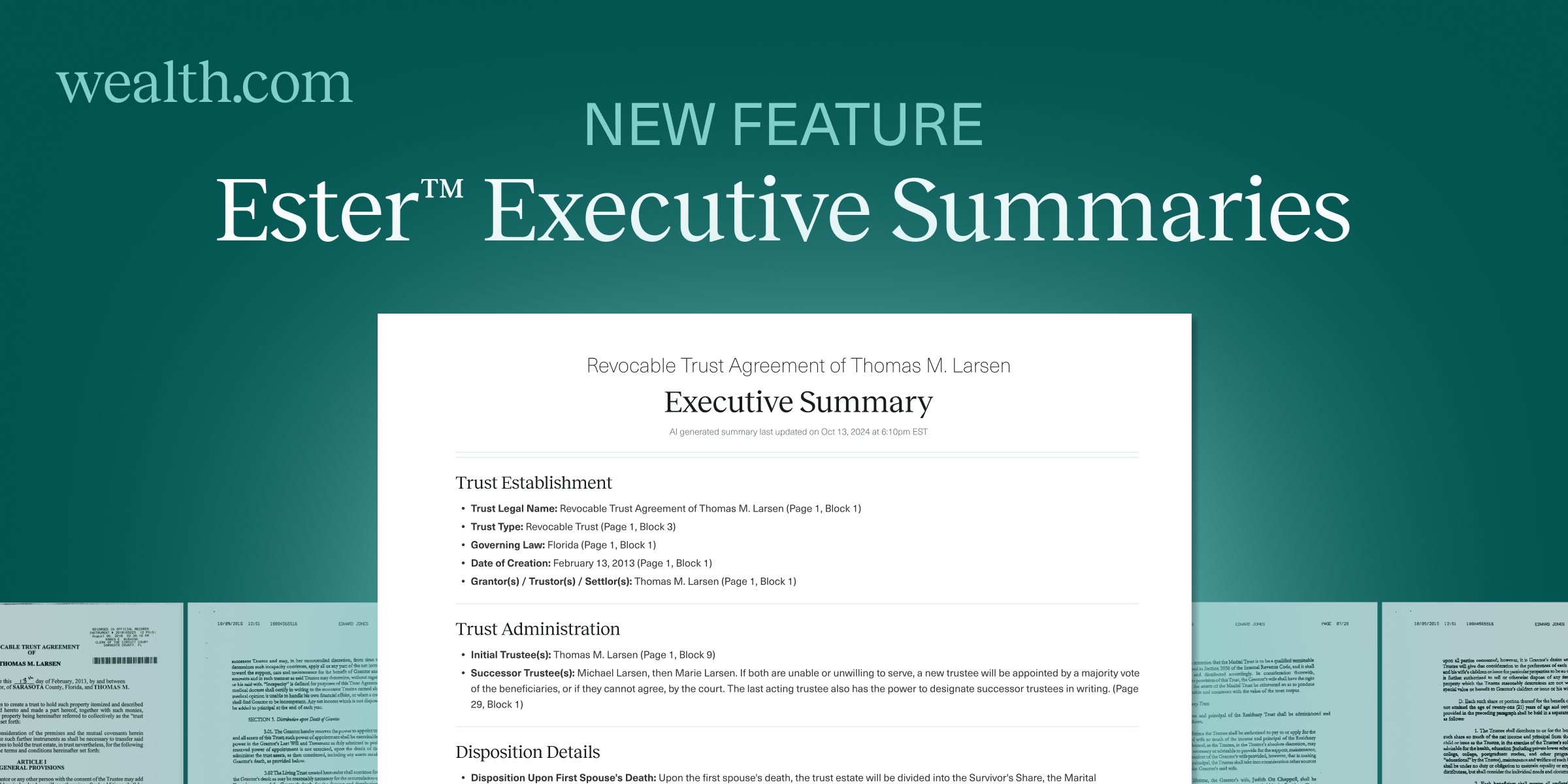

We recently announced the ability to generate Executive Summaries with Ester™, our AI assistant. The Executive Summary is available to be used for new document types, including Grantor Retained Annuity Trusts (GRATs), Irrevocable Life Insurance Trusts (ILITs) and Spousal Lifetime Access Trusts (SLATs).

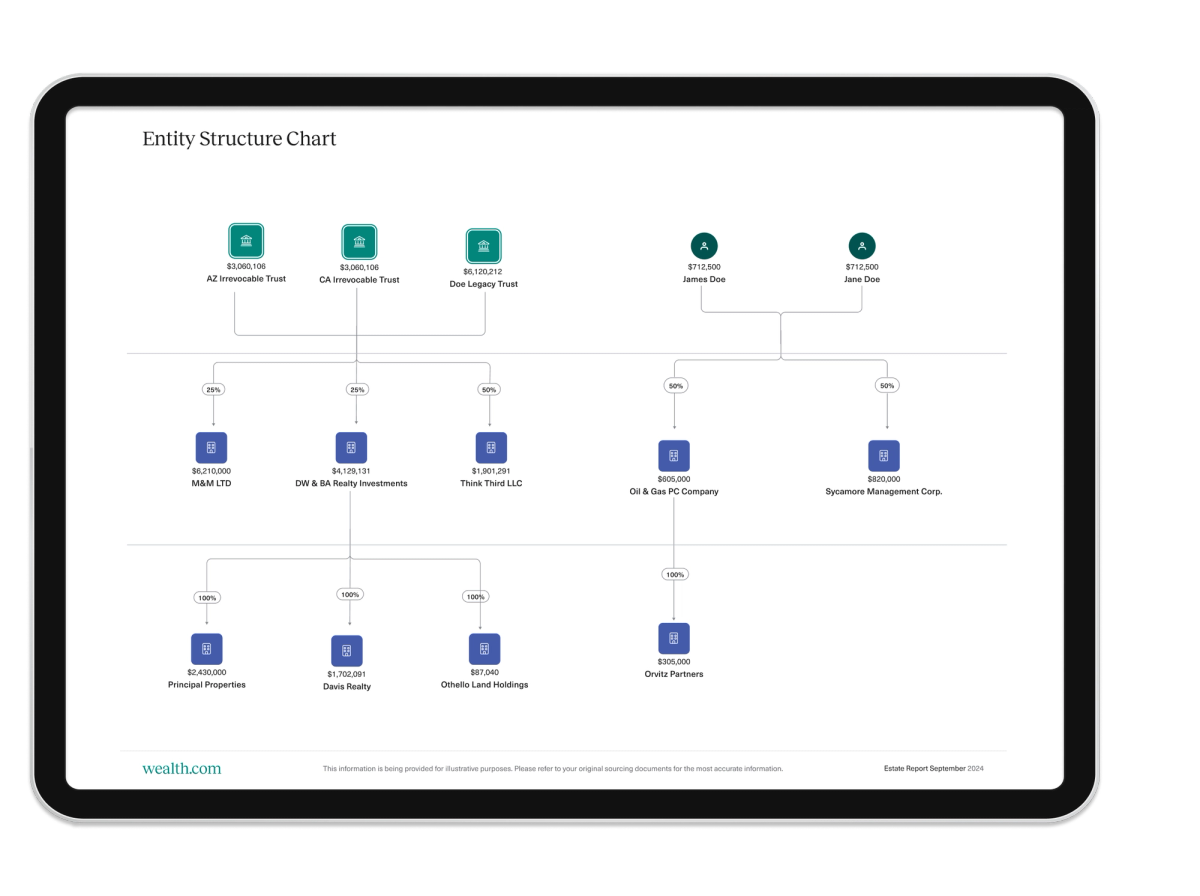

This advancement with Ester™ is a game-changer for advisors, synthesizing even the most complex documents to transform provisions to be comprehensible, offering deeper insights,and feeding into automatically generated visualizations to be included in reporting.

You can read more about this release, and the completely redesigned Ester™ Visualizer Report, here.

Collaborate with the Task Center: Create tasks, add assignees & email notifications

Keep client goals on track with the latest enhancements we’ve made to your Task Center. Easily manage tasks like client onboarding, document creation and reviews by assigning responsibilities to team members and setting up notifications to stay updated on their progress. With a clear task roadmap and automatic email alerts, you’ll ensure that clients’ estate plans and deliverables stay on track.

These enhancements include the ability to:

- Create tasks for individual clients.

- Write a title for each individual task.

- Assign multiple task owners.

- Assign multiple “watchers” or people that want to be kept in the loop on progress.

- Assign a priority level for each task.

- Toggle email notifications on or off for each task.

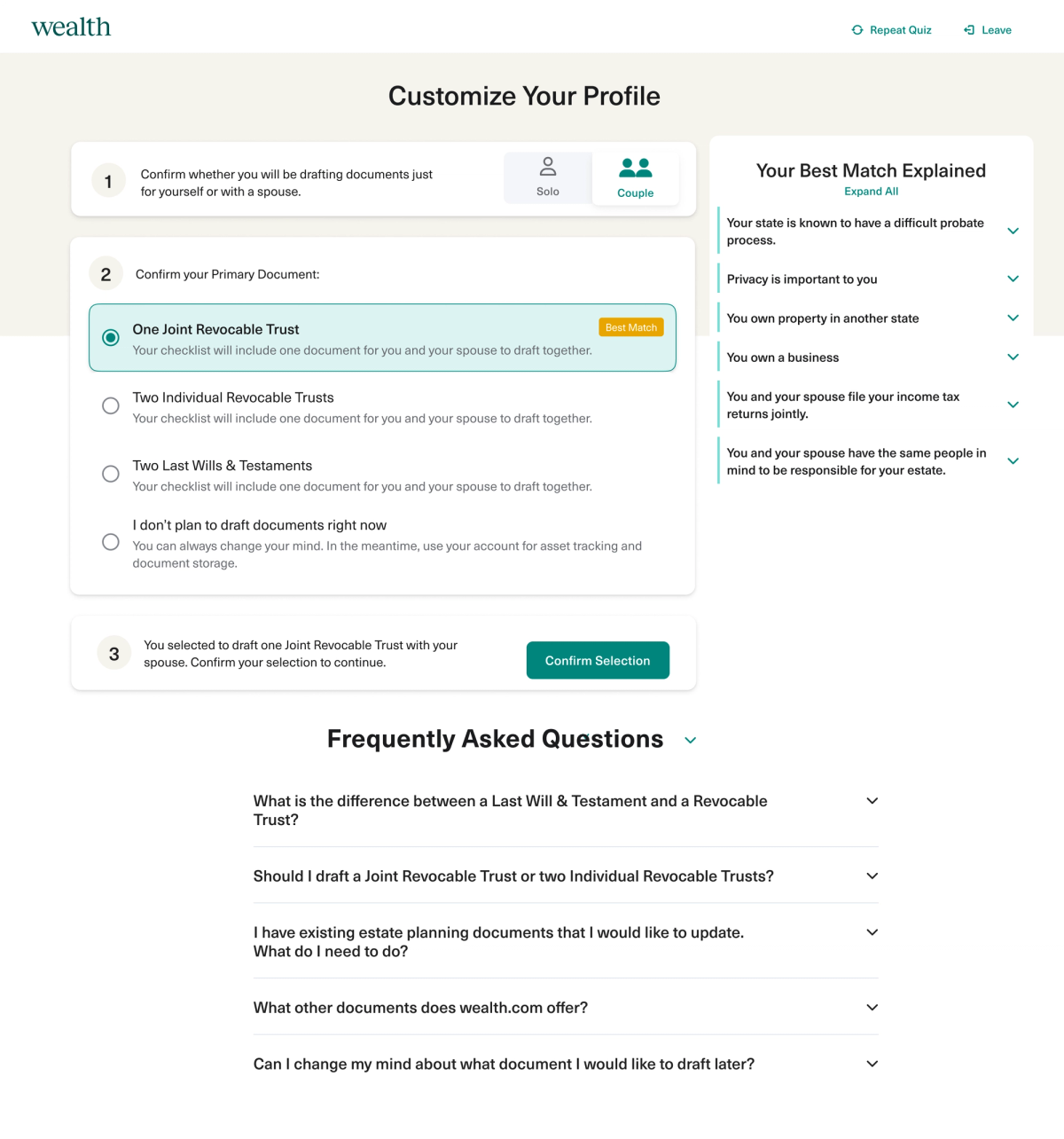

Improved client onboarding experience

We’ve made changes to the onboarding experience for clients to help them navigate their estate planning journey with greater confidence, taking their goals and unique circumstances into consideration.

We’ve streamlined the document recommendation and selection process by making updates to our intake quiz. Clients can also now select the documents they would like to draft based best on their best match and preferences.

This enhanced experience includes:

- Simplified questions: We’ve redesigned the question format to more efficiently identify clients estate planning needs based on their personal circumstances.

- Confirm document recommendation: After clients complete their intake questionnaire, they have the ability to review their document recommendation alongside other options and confirm their pre-selected match or make a change.

- Improved FAQ & educational materials: Clients can access updated educational material throughout the onboarding experience to understand how their circumstances impacted their estate planning document recommendation and to view answers to frequently asked questions about the estate planning process, including the difference between a Revocable Trust and Last Will & Testament.

Easily copy client invitation links

We’ve made it even easier for advisors to guide clients through their estate planning journey. Advisors can now copy unique invitation links directly from the Advisor Portal and share them wherever it’s most convenient—whether in emails, checklists or client communications.

Ready to explore these new features and more? Book a demo now to see how wealth.com can transform your estate planning process for 2025 and beyond.