Estate Planning Software Built for How You Actually Work

Whether you serve a dozen families or a thousand, Wealth.com delivers the tools, insights, and automation to make estate planning efficient, scalable, and personalized—without compromise.

Proudly trusted by:

Pricing Plans

- End-to-End Estate Plan Creation & Execution

- Supports Simple to Ultra-High-Net-Worth Estates

- Trust, Will, and Beneficiary Design Tools

- Attorney Collaboration & Review Workflows

- Branded, Client-Ready Estate Plans

- Multi-year, Multi-State Tax Modeling

- Tax Planning Integrated with Estate Planning

- AI-Powered Tax Analysis

- Branded Client Reports

- Pre-Built Tax Strategies & Quick Actions

- Unified Tax & Estate Planning in One Platform

- Multi-Year, Multi-State Tax Modeling

- Estate Plan Creation, Execution, and Ongoing Updates

- AI-Powered Insights Across Tax and Estate Scenarios

- Client-Ready Reports for Advisors and Families

The Enterprise Standard for Estate & Tax Planning

Wealth.com is the estate and tax planning platform trusted by leading institutions across the country. From national enterprises to complex multi-affiliation firms, our enterprise pricing and implementation model supports secure, scalable, firm-wide adoption.

Family Office Suite

Proven ROI for You and Your Clients

Advisors using Wealth.com are seeing stronger retention, deeper wallet share, and faster growth.

See Real ResultsFrom high-caliber plan creation and interactive scenario modeling to AI-powered tools that summarize legal documents, Wealth.com equips your firm to save time, serve clients better, and grow smarter.

Create High-Caliber Estate Plans in Minutes

Revocable Trust and Pourover Will, Last Will & Testament, Financial Power of Attorney, Advance Health Care Directive, and Guardianship Nominations—professionally crafted and optimized for your jurisdiction.

Start Creating

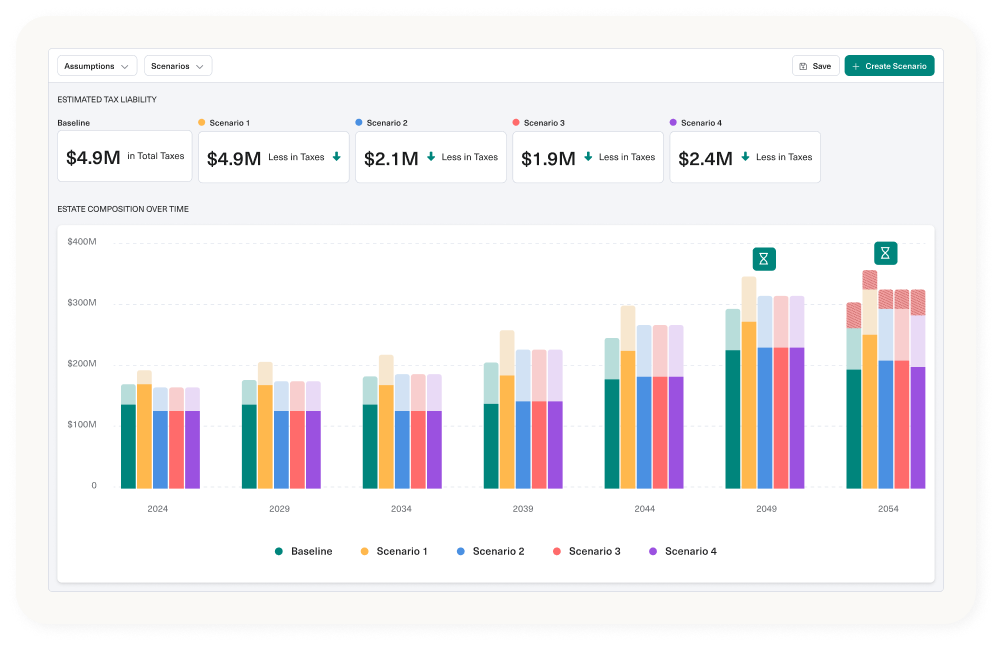

Visualize Every What-If with Confidence

Analyze tax implications, estate distributions, and planning opportunities by testing scenarios against a client’s current plan—all in one powerful tool.

See the Strategy

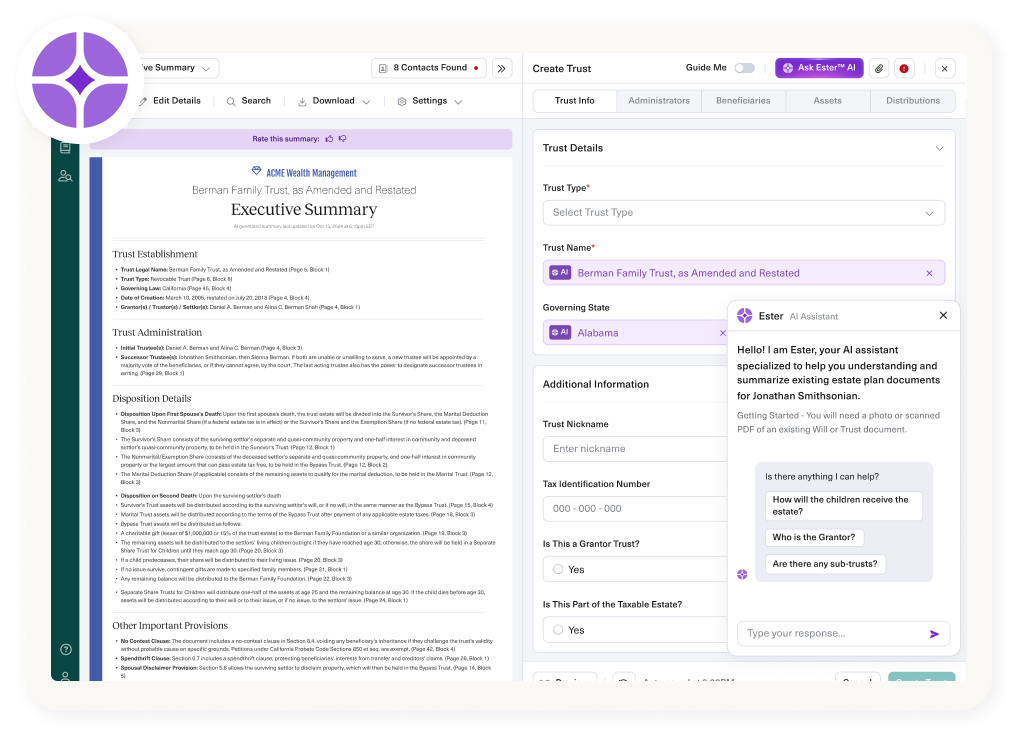

Unlock the Intelligent Future of Estate Planning

Ester™ empowers you to effortlessly extract, summarize, and visualize complete estate plans—turning complex documents into actionable insights for clients.

Meet Ester™Our Feature-Packed Platform Doesn’t End There

Frequently Asked Questions

Explore answers to the questions we hear most so you can move forward with peace of mind.

Each license is made to match an advisor’s book of business, with no per‑client or per‑document fees. Your license also includes full onboarding, implementation support, and standard integrations at no additional cost.

Our platform empowers advisors to lead estate planning conversations and deliver more value, without ever providing legal advice or drafting legal documents themselves. We maintain strict role separation through features like advisor-client portal firewalls, embedded attorney consultations, and controlled workflows that keep legal functions where they belong.

The result: clients receive high-quality estate plans, advisors stay fully within their professional scope, and firms gain confidence that compliance is built into every step.