Kicking off back-to-school season, our product team has been hard at work developing new features designed to streamline your workflow and enhance your client’s experience. This month, we’re thrilled to introduce a host of powerful new updates, from expanded capabilities for Ester® to new scenarios in EstateFlow™ and a more seamless way for clients to request deed transfers.

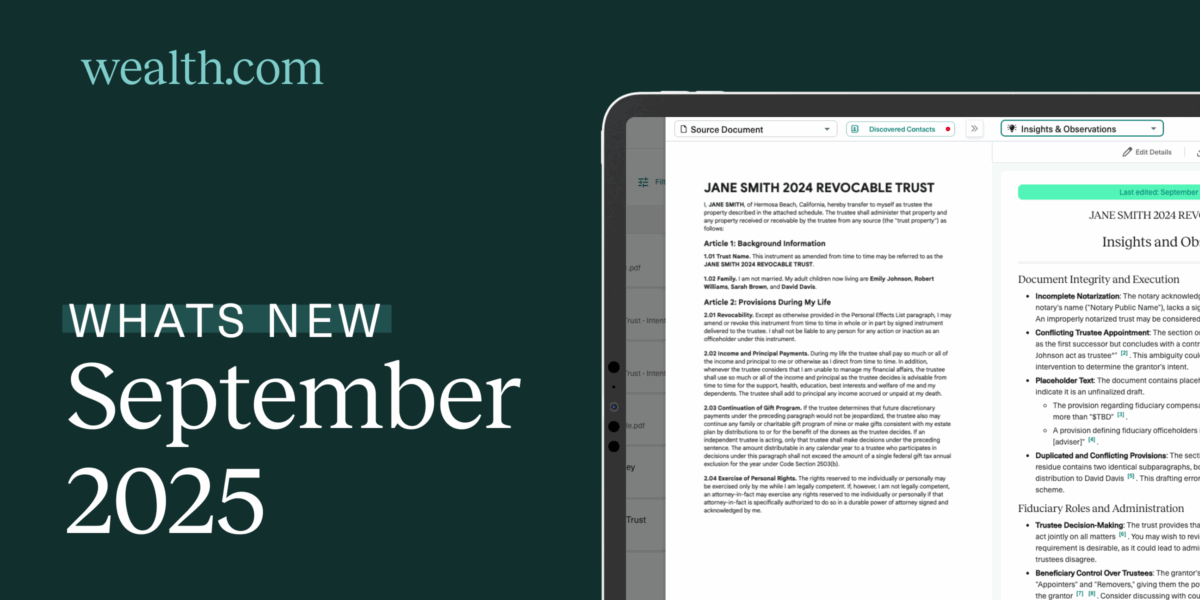

Introducing Ester Insights: Guidance Beyond Summaries

Ester Executive Summaries have always provided factual, citation-rich summaries. Now, the new Ester Insights & Observations tab adds an extra layer of advisory-level intelligence.

- Flags missing or incomplete documents

- Surfaces ambiguities that may require advisor follow-up

- Suggests logical next steps

- Alerts you if something is out of date due to changes triggered by new laws

This feature ensures you’re not just informed, but equipped with actionable guidance. Learn more about Ester® Insights and other recent updates in Wealth Academy.

Ester Advanced Summaries: More Depth for Complex Trusts

For advisors working with complex trusts, Advanced mode adds depth where it’s needed most. You can now toggle Ester into Advanced mode, which prompts even more detailed executive summaries with additional fields designed to capture nuances of complex trusts. Ester summarizes documents with amendments, so when you’re viewing in Advanced Mode, you’ll see a dedicated column for Amendment Details.

At a glance, Ester Advanced provides:

- 50+ new summary fields that capture nuance in sophisticated estate plans

- Amendment-specific visibility with a dedicated “Amendment Details” column

- Smarter document handling that recognizes amendments automatically

See what else is included in Ester Advanced Summaries in Wealth Academy.

Ester Now Reviews LLCs, Operating Agreements, and Amendments!

You asked, and we delivered: Ester now reviews LLCs and Operating Agreements (OAs) as well as documents with Amendments. For documents with Amendments, Ester® Executive Summaries features a new column titled Amendment Details, which calls out key information related to amendments. This means a broader, more accurate view of your clients’ estate planning documents without additional manual review.

Deed Transfer Requests Made Simple for Clients

Wealth.com now offers a streamlined, end-to-end process for transferring real estate into a trust, available in all 50 states at a single, pre-negotiated flat rate.

Here’s how it works:

Log into your Wealth.com account and navigate to your account profile.

From there, select Attorney Services and choose Transfer Real Estate.

- Clients will be connected with our attorneys to complete their deed preparation, without ever having to exit the Wealth.com platform.

The service is offered at a flat rate of $175 per deed filing nationwide, with recording fees varying by state and county, and Wealth.com will confirm the exact recording cost once all required documents are received. This upgrade ensures clients can seamlessly transition from trust creation to deed preparation, keeping the process efficient and secure.

Why This Matters for You and Your Clients:

- For Advisors: Faster reviews, smarter guidance, and more complete visibility into client documents.

- For Clients: A simpler, guided experience that reduces friction and builds confidence.

- For Firms: A stronger, more scalable process that demonstrates the value of modern estate planning.

That’s a wrap on September. As always, explore full release notes and tutorials in Wealth Academy to see these updates in action.