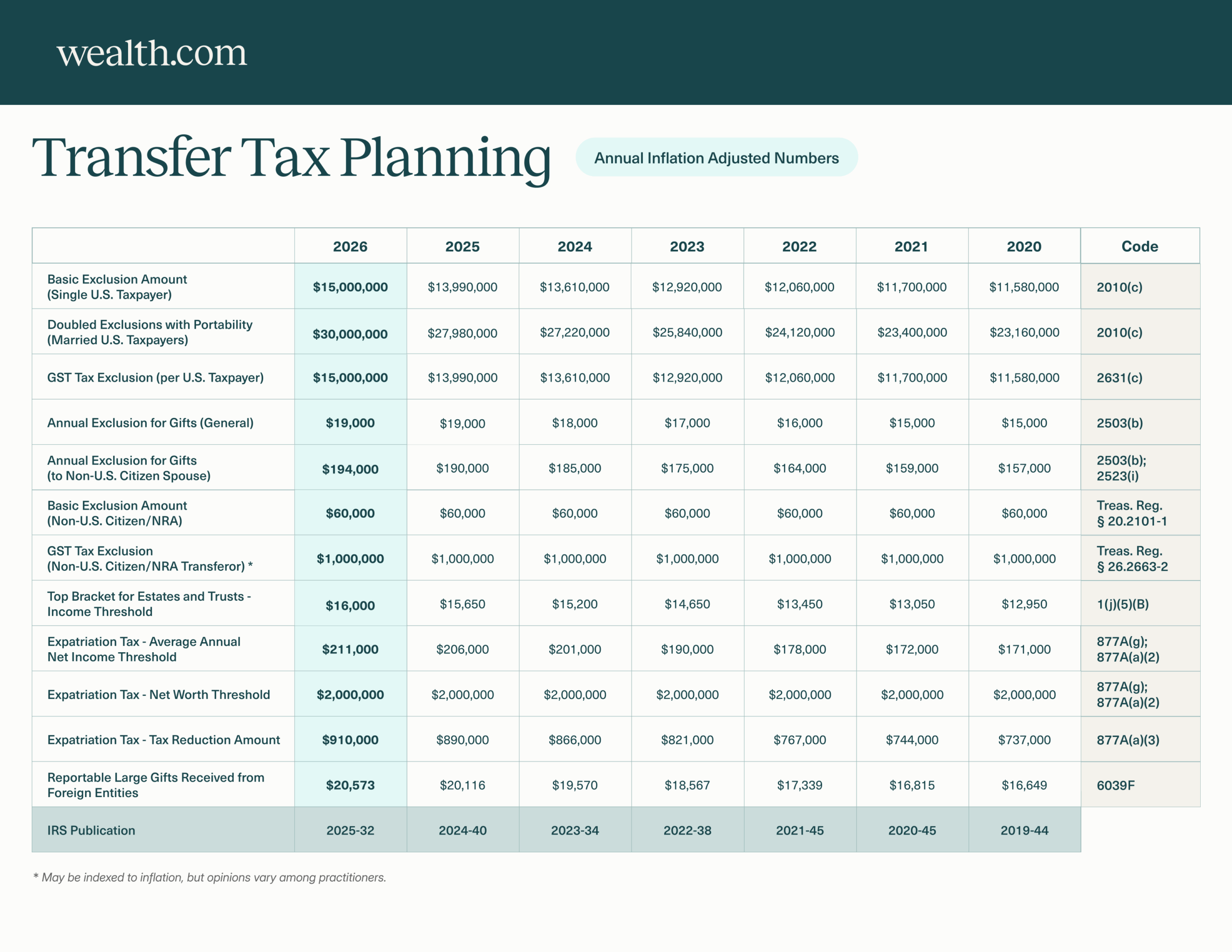

The IRS has officially released its inflation-adjusted numbers for the 2026 tax year. These can have a significant impact on transfer tax and estate planning.

Due to the passage of the One Big Beautiful Bill Act, the lifetime estate and gift tax exemption was previously announced in July with a new base of $15 million per individual. The IRS has confirmed this number for 2026 and further clarified that for tax years beginning after 2026, this new $15 million dollar base will again be adjusted annually for inflation.

In a notable departure from recent trends, the annual gift tax exclusion will remain at $19,000 for 2026. This breaks a four-year streak of increases. For those accustomed to the $1,000 yearly increase, it will be key to inform your clients that this amount is remaining unchanged.

That’s why it is critical to review these 2026 numbers alongside your clients’ plans to understand if there is any impact or opportunities for new estate tax strategies next year.

We reviewed Revenue Procedure 2025-32 and pulled out the most relevant numbers for transfer tax planning to provide you, and your clients, a simple reference chart. View it below or download a version that you can keep handy.

Actionable takeaways & impacts

While the impact of these transfer tax planning numbers on your clients’ estate plans will depend on their financial situation, for example, individuals with a taxable estate well under $15 million are likely to be unaffected by the lifetime exemption, there are potential strategies you can employ for those that could be impacted.

Here are some examples of how you can use these numbers to create a strategy for affected clients in 2026:

1. Maximize lifetime wealth transfer

Your clients can contribute significantly to irrevocable trusts and/or make substantial gifts without incurring taxes due to the increase in the lifetime estate and gift exemption to $15 million for individuals and $30 million for married couples.

This allows you and your clients to optimize their estate planning strategies.

2. Monitor taxable gifts

Next year, the annual gift tax exclusion is remaining at $19,000.

If a client already has a gifting strategy in place, for example providing gifts to their grandchildren every year, make sure they know that unlike in previous years the non-taxable gifting amount should remain the same.

You should also ensure that you’re helping them track their gifting amounts. If they exceed the $19,000 they will need to file a Form 709 to report taxable gifts.

3. Evaluate trust tax implications

If your clients are considering irrevocable trusts, you should assess who will be the taxpayer for the trust. If the trust is considered a grantor trust, your client (and not the trust) will report and pay the taxes on income generated inside the trust.

This evaluation helps your clients weigh potential estate tax savings against higher income taxes, providing a clearer financial picture for them.

4. Understand non-resident alien tax implications

Be mindful of the different estate and gift tax thresholds that apply to non-resident aliens. These can have a significant impact on planning strategies.

This chart will help you navigate those complexities more effectively.

5. Address expatriation and foreign gifts

For your clients that are considering moving to a foreign country, renouncing their citizenship or green card status and/or receiving large gifts from abroad, you should be aware of the reporting requirements and tax implications.

Staying proactive now will help ensure your clients are fully prepared for the 2026 changes. Use these updated thresholds to revisit their plans, refine your strategies, and position yourself as the trusted advisor who helps them make the most of every opportunity.