Built for Advisors. Trusted by Families.

Estate planning made simple, scalable, and deeply personal for every client in your book.

Trusted Estate Planning Solution for the Industry’s Leading Firms

Build Estate Plans That Are Comprehensive and Surprisingly Easy

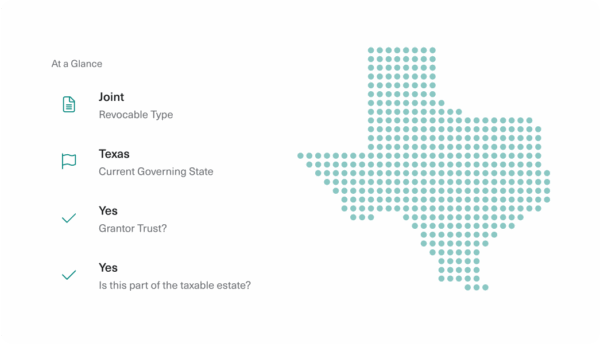

Serve clients in all 50 states with confidence. Wealth.com offers state-specific legal expertise and guidance, backed by our in-house and national legal network — so you're never out of scope.

Receive and deliver a truly white-glove experience. You and your clients get direct access to trust-certified mobile notaries, attorney consults, and our U.S.-based support team, all within the Wealth.com platform.

Create unlimited estate plans — no per-document fees, no hidden charges. Serve every client with confidence, knowing your costs are predictable and your service is scalable.

Deliver estate plans in minutes, not months giving you the ability to spend more time advising clients on what truly matters. Wealth.com makes high-quality estate planning fast, scalable, and client-ready.

Cut Costs, Save Time, and Increase Revenue with Wealth.com

Advisors using Wealth.com save up to 40 hours on complex ultra-high-net-worth plans, generate $1,000+ in revenue per estate plan, and see 2.2X AUM growth within 18 months. Estate planning doesn’t just protect legacies — it transforms your business.

Start Growing RevenueBuild Trust with Families Across Generations

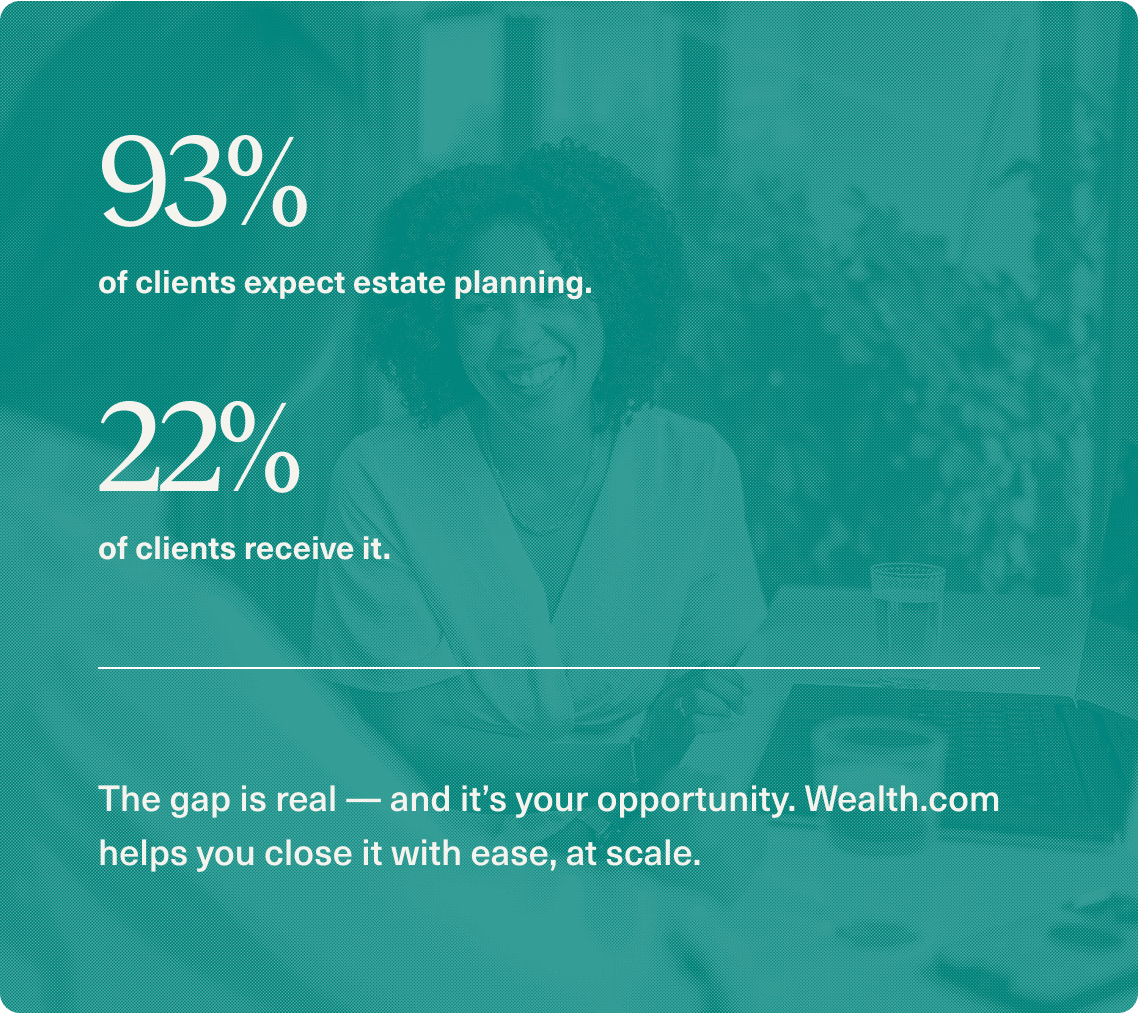

Estate planning is the bookend to any good financial plan — without it, the picture is incomplete. You don’t just provide documents — you offer a roadmap. A direct line of sight into the next generation and the trust that comes with it.

Own the Entire Estate Planning Process

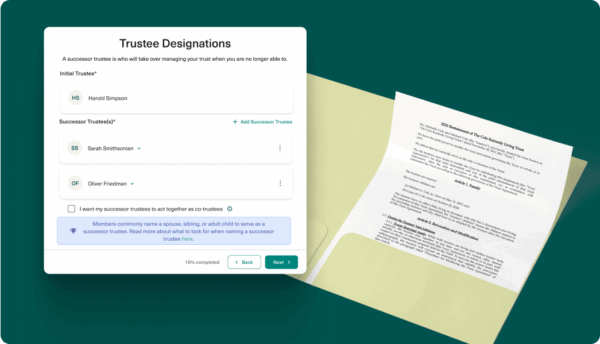

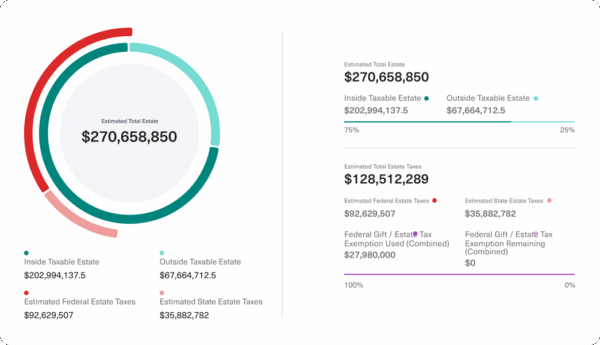

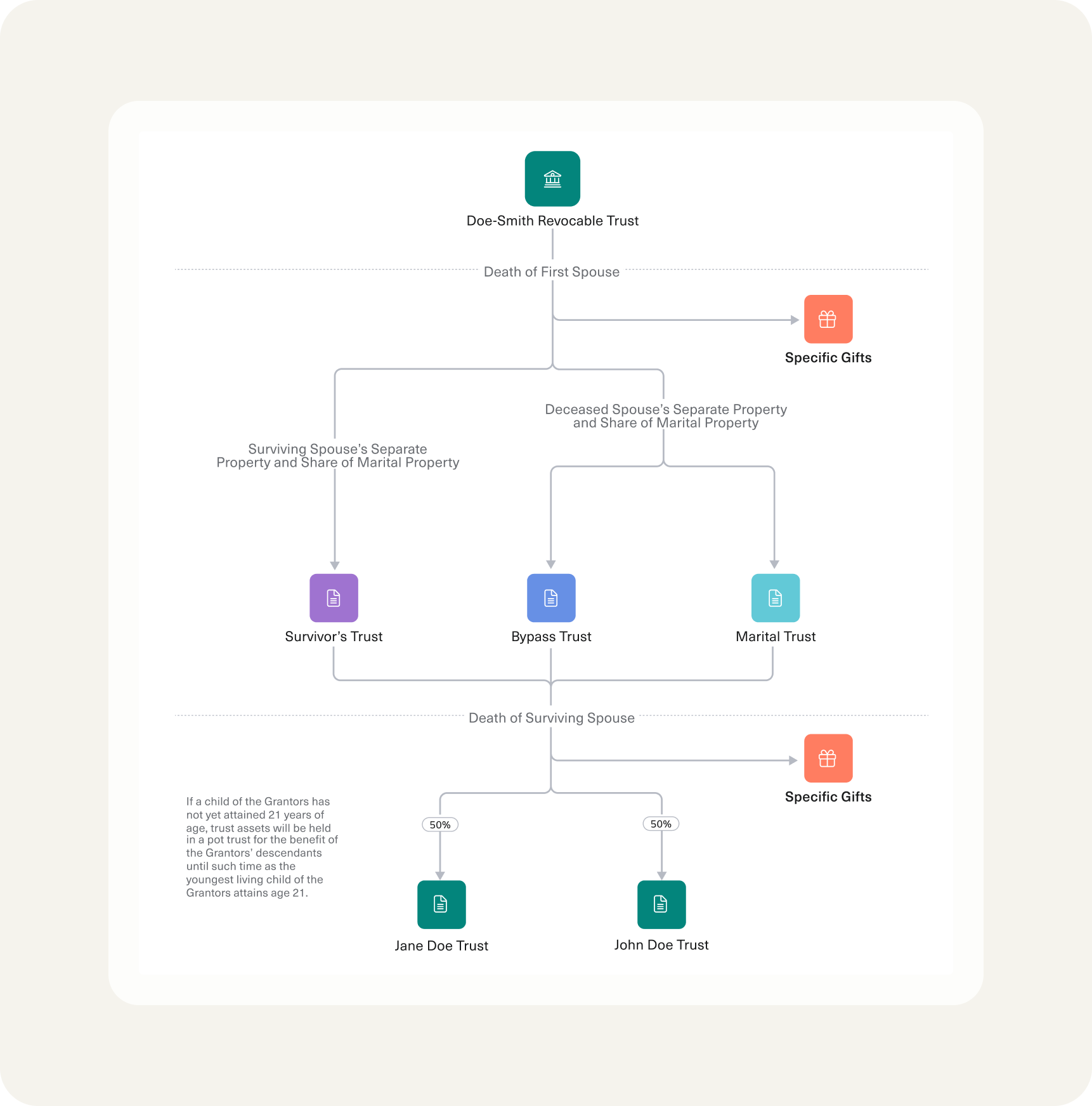

With Wealth.com, every part of your client’s estate plan becomes easy to see, explain, and act on — no legal background required.

- Visualize distribution schemes for every estate plan

- Understand how assets are owned

- Quantify tax implications and identify optimization opportunities