A firm’s website is often the first impression for prospective clients, and for many, it sets the tone for the entire advisory relationship. The strongest advisor websites do more than explain services; they communicate credibility, reflect a clear point of view, and make it easy for the right clients to engage.

As firms compete for next-generation clients and multigenerational relationships, digital presence has become a strategic asset. The most effective sites balance clarity with sophistication, and marketing with substance.

Below, we highlight a selection of advisor websites that stand out heading into 2026. Each reflects a thoughtful approach to client experience, brand positioning, and long-term growth.

1. Fiat Wealth Management

Leadership: Bradly Gotto (Founder)

Website: fiatwm.com

Why it works: Fiat excels at visual storytelling, using high-quality video and bold branding to immediately humanize the firm. Their focus on “Tax-Focused Wealth Management” is prominent, instantly qualifying visitors who are looking for more than just investment advice.

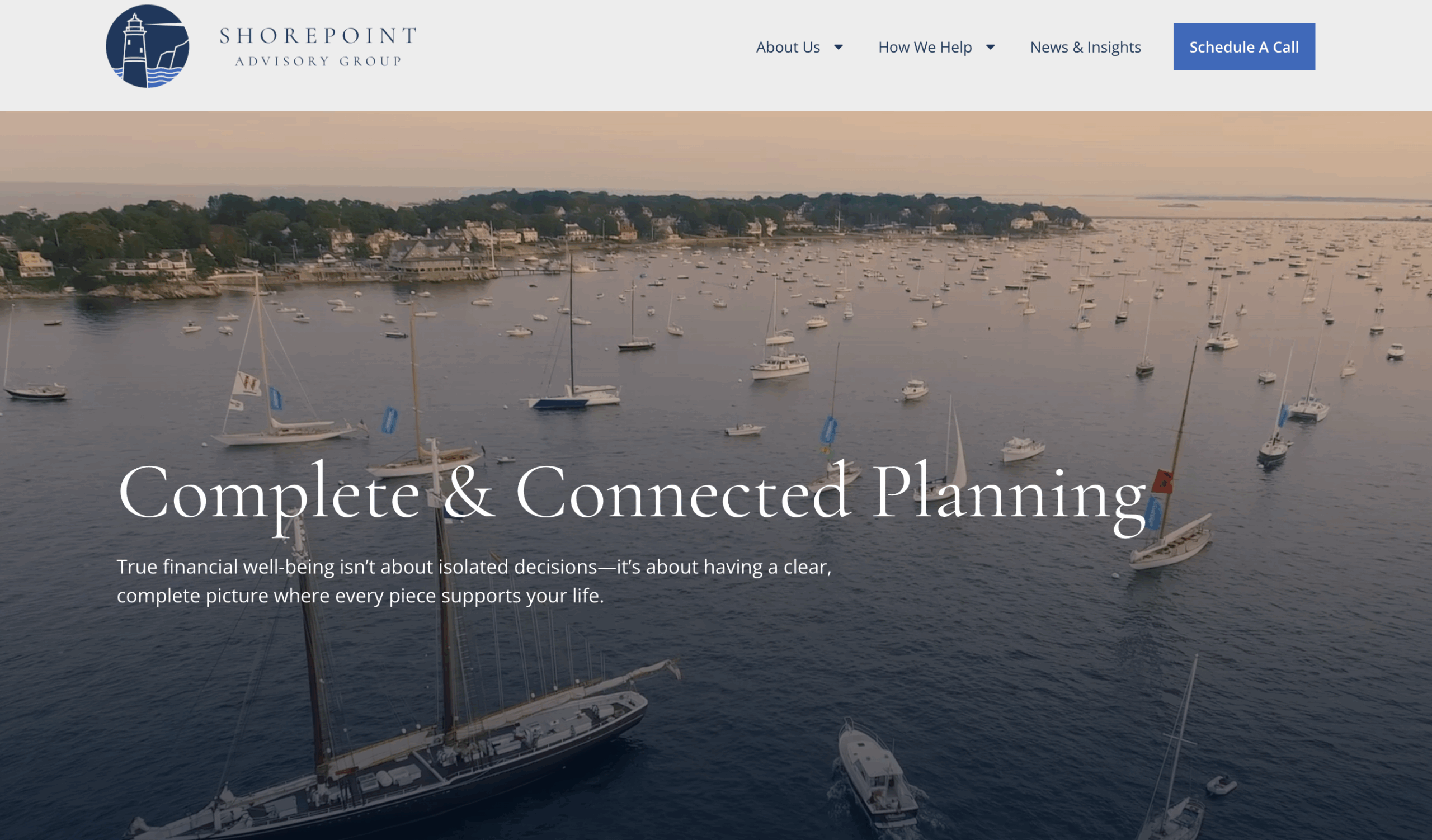

2. ShorePoint Advisory Group

Leadership: Emily Promise (CEO and CFP® Professional)

Website: shorepointadvisorygroup.com

Why it works: ShorePoint uses an “Investor Coach” framework that shifts the dynamic from sales to education. Their site builds trust through transparency, offering clear explanations of their philosophy to demystify the investment process for hesitant clients.

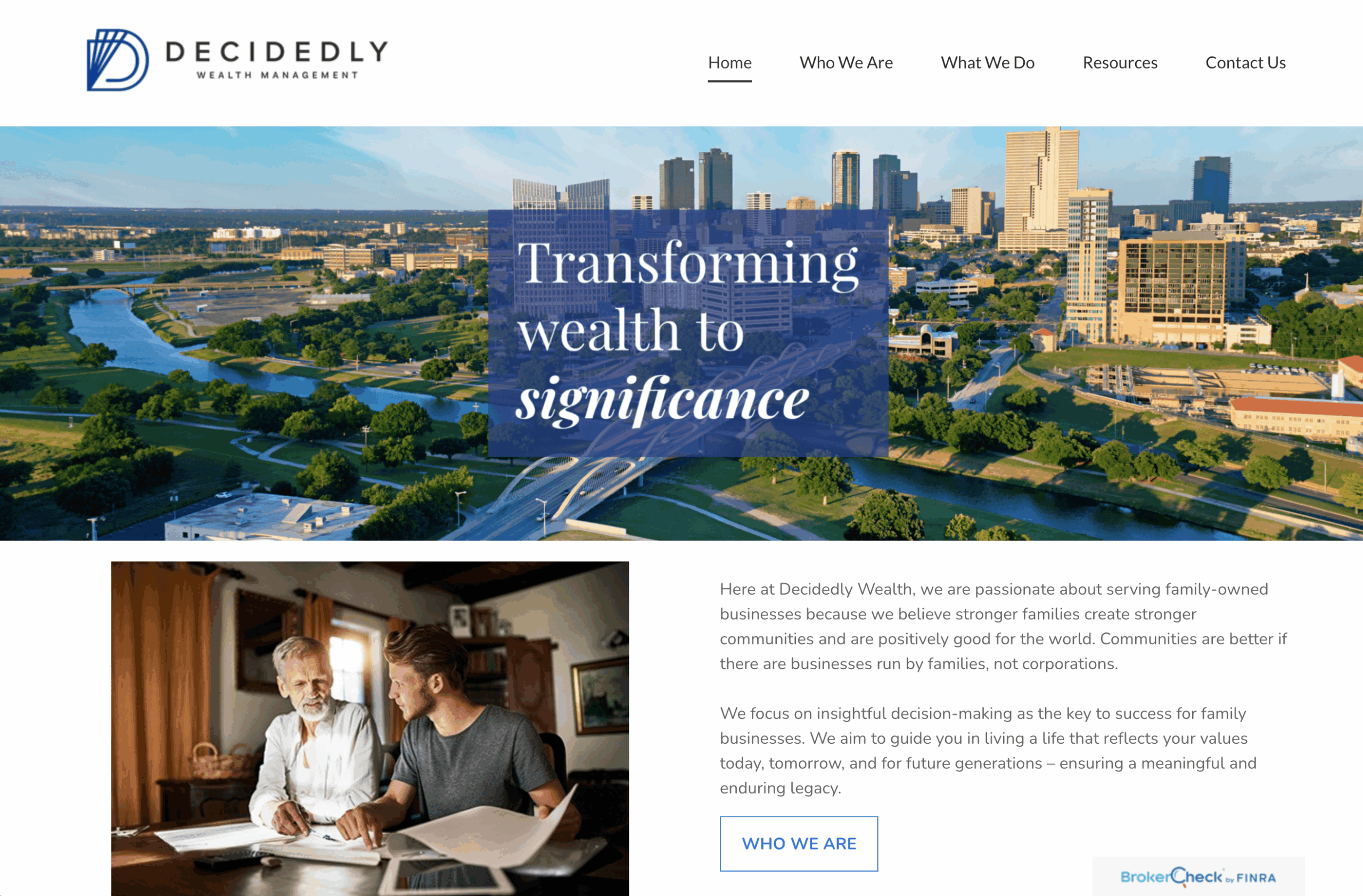

3. Decidedly Wealth Management

Leadership: Sanger Smith (Financial Advisor and Founder)

Website: decidedlywealth.com

Why it works: This site is a masterclass in niche marketing, explicitly targeting family business owners with the tagline “Transforming Wealth To Significance.” The copy speaks directly to the unique emotional and financial challenges of family enterprises, creating an immediate connection.

4. PATH Financial Partners

Leadership: Jason Oestreicher, CFP® and Nick Brown (Co-founders)

Website: pathfinancialpartners.com

Why it works: True to its name, the site leans effectively into the “journey” metaphor without feeling cliché. The navigation is intuitive and goal-oriented, making it easy for visitors to see exactly how the firm guides them from their current financial reality to their desired future.

5. CLC Investment Advisors

5. CLC Investment Advisors

Leadership: David Cadarette (Founder and CEO)

Website: clcinvestmentadvisors.com

Why it works: CLC leverages a clean, minimalist design that prioritizes direct access to leadership. By removing clutter and focusing on the founder-led relationship, the site projects a “high-touch” boutique feel that appeals to clients seeking personalized attention.

6. 9i Capital Group

Leadership: Kevin Thompson (President)

Website: 9icapitalgroup.com

Why it works: The site effectively uses structural metaphors (pillars, foundations) to communicate safety and stability. Their robust resource center positions the firm as a thought leader, helping prospective clients feel more secure in their decision-making.

7. Sedai Wealth

Leadership: Jared Tanimoto (Founder and Financial Planner)

Website: sedaiwealth.com

Why it works: With “Sedai” meaning “generation” in Japanese, the brand identity perfectly aligns with a focus on multi-generational wealth planning. The design is modern yet culturally resonant, appealing strongly to families looking to preserve their legacy across generations.

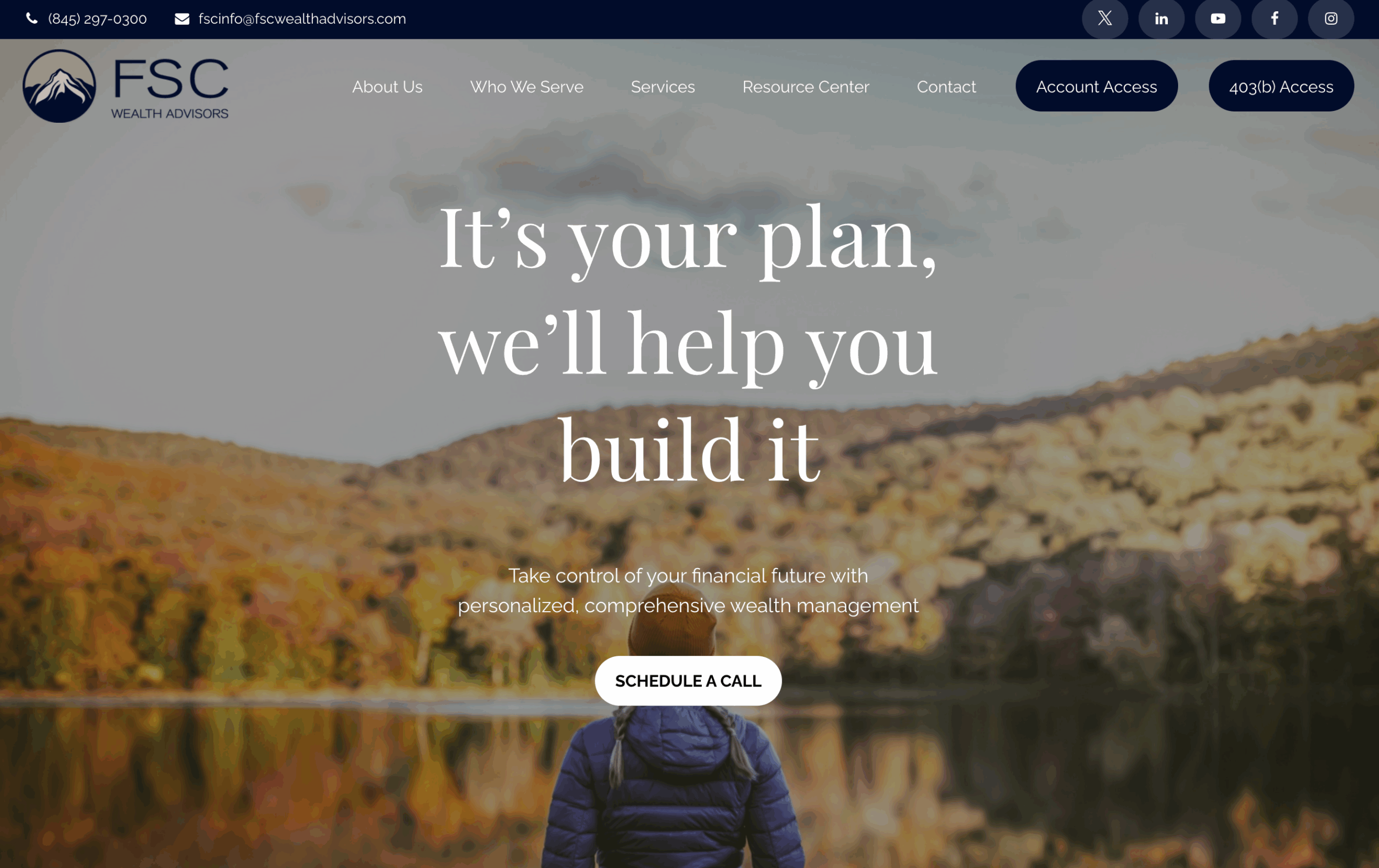

8. FSC Wealth Advisors

Leadership: James Comblo (CEO)

Website: fscwealthadvisors.com

Why it works: FSC uses direct, action-oriented messaging (“Gain command over your financial future”) that resonates with their target audience of executives and business owners. The site clearly segments services by client type, allowing visitors to quickly find the information relevant to them.

9. Baobab Wealth Management

Leadership: James Miller (Founder)

Website: baobabwealth.com

Why it works: The homepage offers free resources (guides, downloadable content), reinforcing expertise and giving visitors immediate value before they contact the firm.

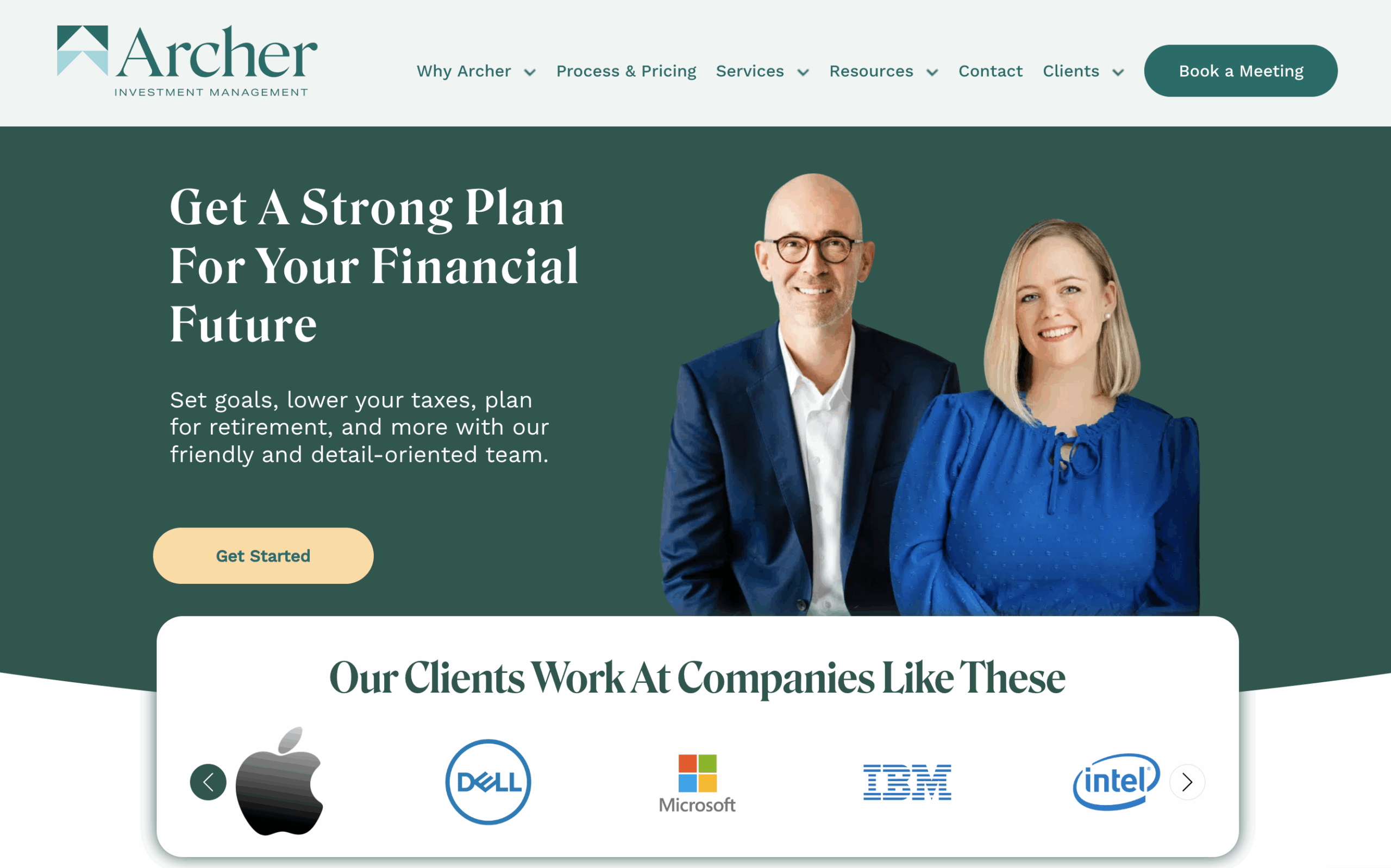

10. Archer Investment Management

Leadership: Richard Archer and Emily Rassam

Website: archerim.com

Why it works: As a fully digital, tech-forward firm, Archer’s website mirrors the efficiency of their service model. The design is sleek and modern, signaling to busy professionals that this is a firm equipped to handle their wealth with modern tools and remote capabilities.

Why Digital Presence Matters in 2026

A strong website does not replace relationships, but it reinforces them. For advisors, it serves as a durable extension of the firm’s brand and a clear expression of how you work with clients.

The advisors featured here demonstrate that thoughtful digital design supports trust, differentiation, and scale. As expectations continue to rise, firms that invest in their online presence will be better positioned to attract the right clients and sustain growth.

Whether you are refining your site or planning a full redesign, the examples above offer a practical look at what works, and why it matters.