Spring is all about fresh starts and this month’s release delivers exactly that. From AI that can field your nuanced estate‑planning questions to a one‑click eMoney integration that auto‑loads client data, we’ve focused on turning hours of manual work into minutes. You’ll also find new ways to customize the Ownership Balance Sheet, tighter guard‑rails that prevent data gaps, and a long list of UX polish inspired directly by your feedback. Dive in below, and let us know what you think!

Ask Ester Anything and Bulk Upload

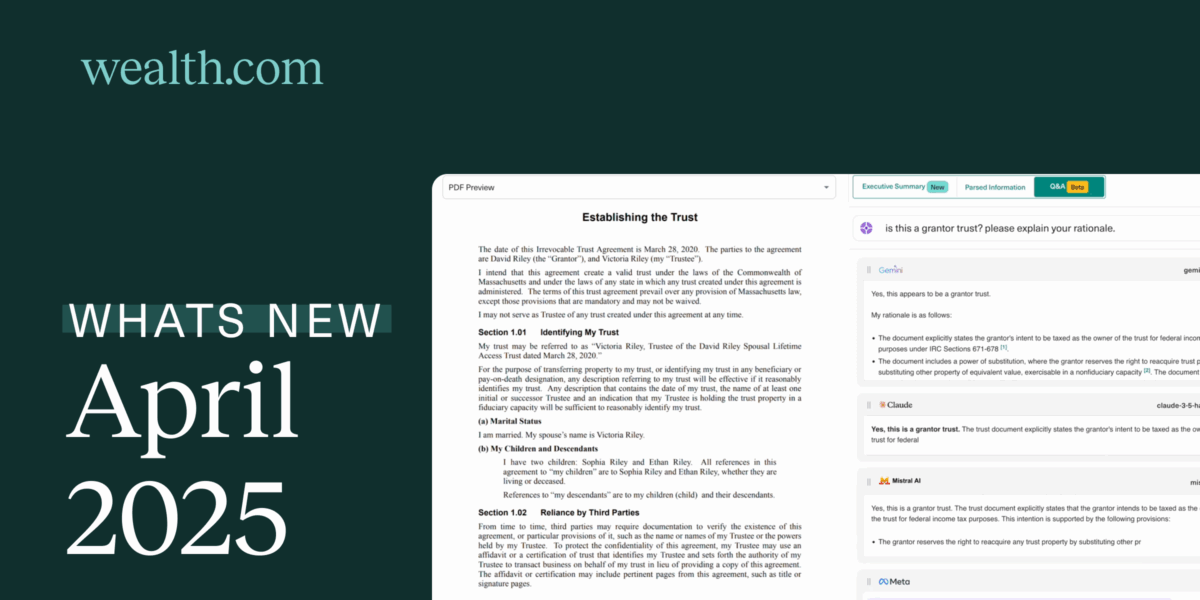

Free-form Q&A, multiple AI perspectives

Ester already parses estate‑planning documents and surfaces key details. Now it also answers your open‑ended questions like, “Does this trust allow discretionary distributions?” and shows side‑by‑side answers from four leading models (Gemini, Claude, Mistral, Meta). Compare viewpoints instantly, gain clarity faster.

Review entire document sets at once

Have a client with a will, trust, and healthcare directive? Drag‑and‑drop the whole folder and let Ester run concurrent reviews. No more uploading one file at a time.

eMoney integration: Import Clients & Assets in Seconds

Connect your eMoney credentials, choose the households you want, and watch Wealth.com pull in client profiles and asset data automatically. With live numbers at your fingertips, you can model strategies with confidence. No CSV jockeying required.

Coming soon: two‑way vault sync so the latest documents stay aligned in both platforms.

Ownership Balance Sheet: Customized Visual Enhancements

Advisors can now rearrange the order of columns on the ownership balance sheet making it easier for them to organize the balance sheet based on client preferences. Any changes made to the organization of the balance sheet will also be displayed in Report Builder, using continuity of data structure.

Advisors can also more clearly differentiate between assets that are held inside their clients’ estates compared to assets held outside the estates. This provides a quick visual check when considering different estate planning strategies.

Additional Improvements

- Smart validations on Asset, Trust, Will and Entity Cards to guide advisors to add missing information and fix errors to ensure that calculations and data flows correctly in EstateFlow and the Report Builder

- From the Vault, advisors and clients can now upload multiple files at once.

- From the Report Builder, advisors have the option to save a version of the report to the Vault in a new category ‘Presentation Materials’ for future retrieval and to share with clients, alongside making the Settings and Download to PDF / PPT options more accessible with design tweaks based on user behavior

- Client profiles minus email: Advisors no longer have to provide an email address for a client when creating their profile in Wealth, streamlining the account creation process for clients who will not be invited to Wealth

- Estate auto-populate: When an Advisor enters the amount of the exemption a Client has used from the Estate Tax Liability Slide, that value will populate automatically in the EstateFlow configuration panel. The state estate tax rate will also populate based on the Client’s address. This will prevent Advisors from having to manually enter these values in multiple places throughout the platform

- Historical asset values: Advisors can now select a custom “as of” date on the OBS to show asset values on a certain date, helping them streamline their client reporting.

Try It Today

Sign in and test‑drive today’s release inside your own dashboard. Bulk‑upload a client’s documents to Ester, integrate a household from eMoney, or rearrange the Ownership Balance Sheet to fit your story. As always, every note and idea you send shapes what we build next, so keep the feedback coming through in‑app chat or with your Partner Success Manager.