Tax Planning.

Less Taxing.

Wealth.com Tax Planning helps advisors move beyond year-by-year calculations and into long-term planning that compounds across generations. Model forward-looking tax strategies, understand their estate impact, and execute with confidence, all inside Wealth.com.

Power to the Planner

Tax planning used to mean hours of manual entry and dated interfaces. We realized there had to be a better way. So we built Wealth.com Tax Planning. It takes the complexity of the tax code and transforms it into clear, actionable intelligence. It’s powerful enough for your most complex clients, yet simple enough to use every day.

1040? 10-4.

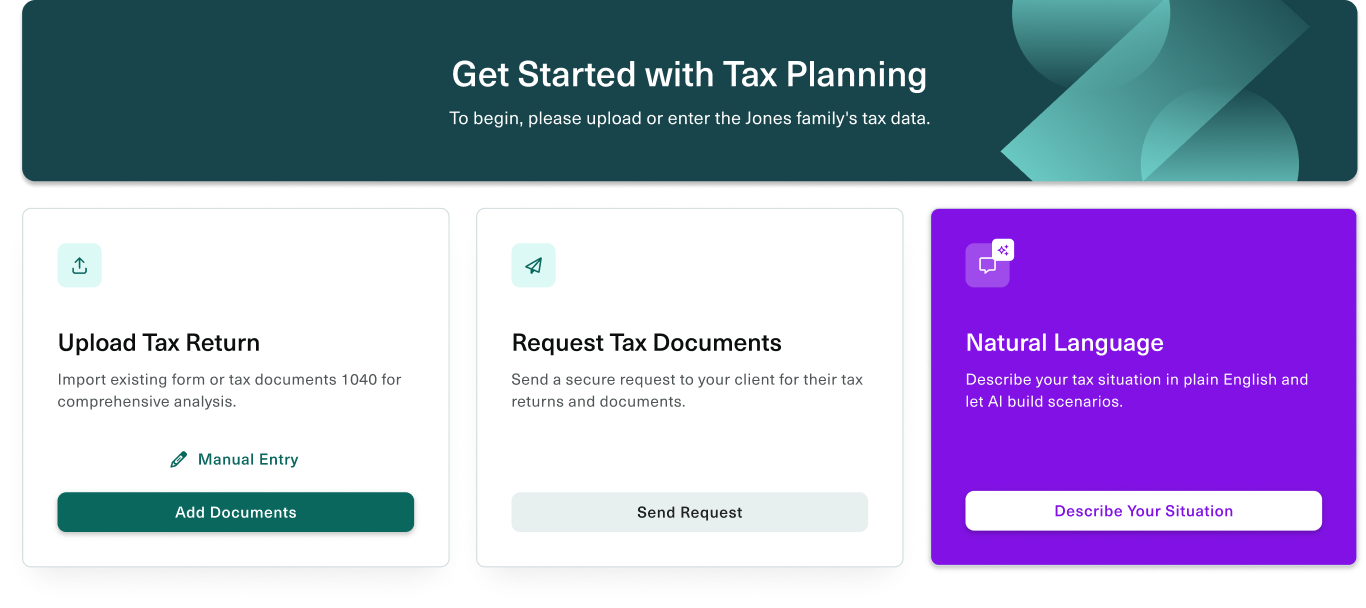

We believe your time is for advising, not typing. So we created three seamless ways to get data in, and kept the friction out.

- Send a link. Skip the chase. Stop the back-and-forth email chains. Send a secure, branded link directly to your client. They upload their tax documents. We convert the data. You get straight to strategy.

- Just say the word. Don’t want to type? Don’t. Use Ester to speak the details out loud. We capture the conversation, parse the specific figures, and input everything for you automatically.

- Drag. Drop. Done. Have the file in hand? Simply drag and drop a PDF of a Form 1040 or W-2. Our engine extracts and validates the data instantly.

Past Meets Future

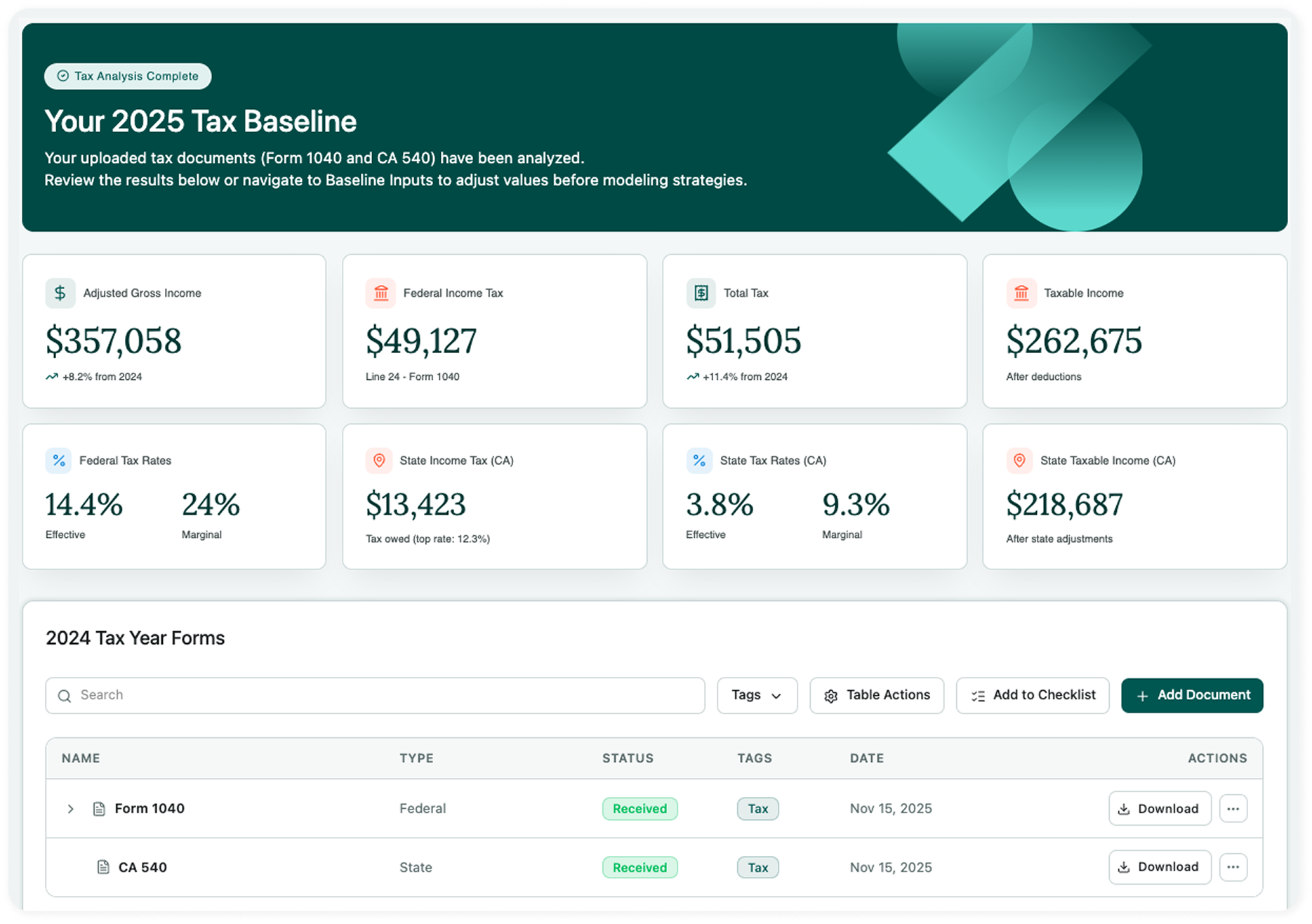

- Look Back. Understand exactly where your client stands. Wealth.com reviews and summarizes past returns to establish a historical baseline. It even automatically runs a Prior-Year Safe Harbor Calculation to estimate current-year payments.

- Look Forward. See what’s coming. Generate a Baseline Report that recalculates historical data against future tax rates and updated standard deductions. Want to see the impact of a salary change? Just adjust the inputs to generate a Projected Report instantly.

Two Speeds. One Purpose.

Sometimes you need an answer now. Sometimes you need a plan for life. Our dual-mode tax estimation and planning adapts to the rhythm of your day.

- Rapid Triage Mode. Speed without the shortcut. When a client calls with a burning question, you shouldn’t have to build a full plan. Use Rapid Triage for quick calculations, like nailing down Q4 estimated payments in seconds.

- Deep Planning Mode. Depth without the drag. When it’s time to look at the big picture, switch gears. Unlock comprehensive annual reviews and event-triggered strategy analysis that covers every angle.

The Estate & Tax Synergy

Tax planning and estate planning don’t happen in a vacuum. We view them as a compound product.

- 1 + 1 = Power. When a client’s tax return changes, like a new child or a change in filing status, our system spots the need to update their estate plan immediately.

- The Roth Ripple Effect. Modeling a Roth conversion? We don’t just show the tax bill. We show the compounding benefit to the beneficiaries’ inheritance decades down the line.

Pro-level strategies.

In-sourced.

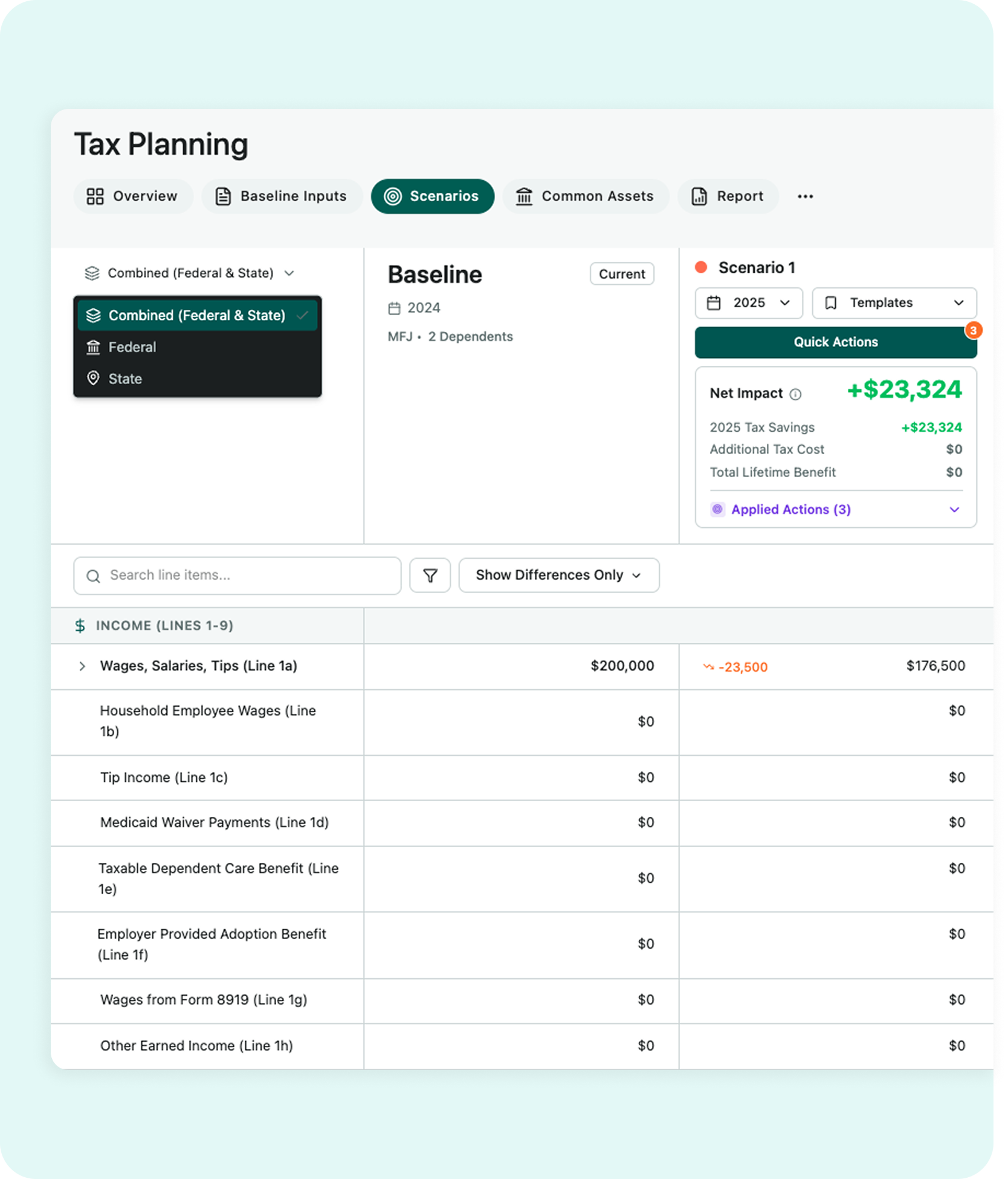

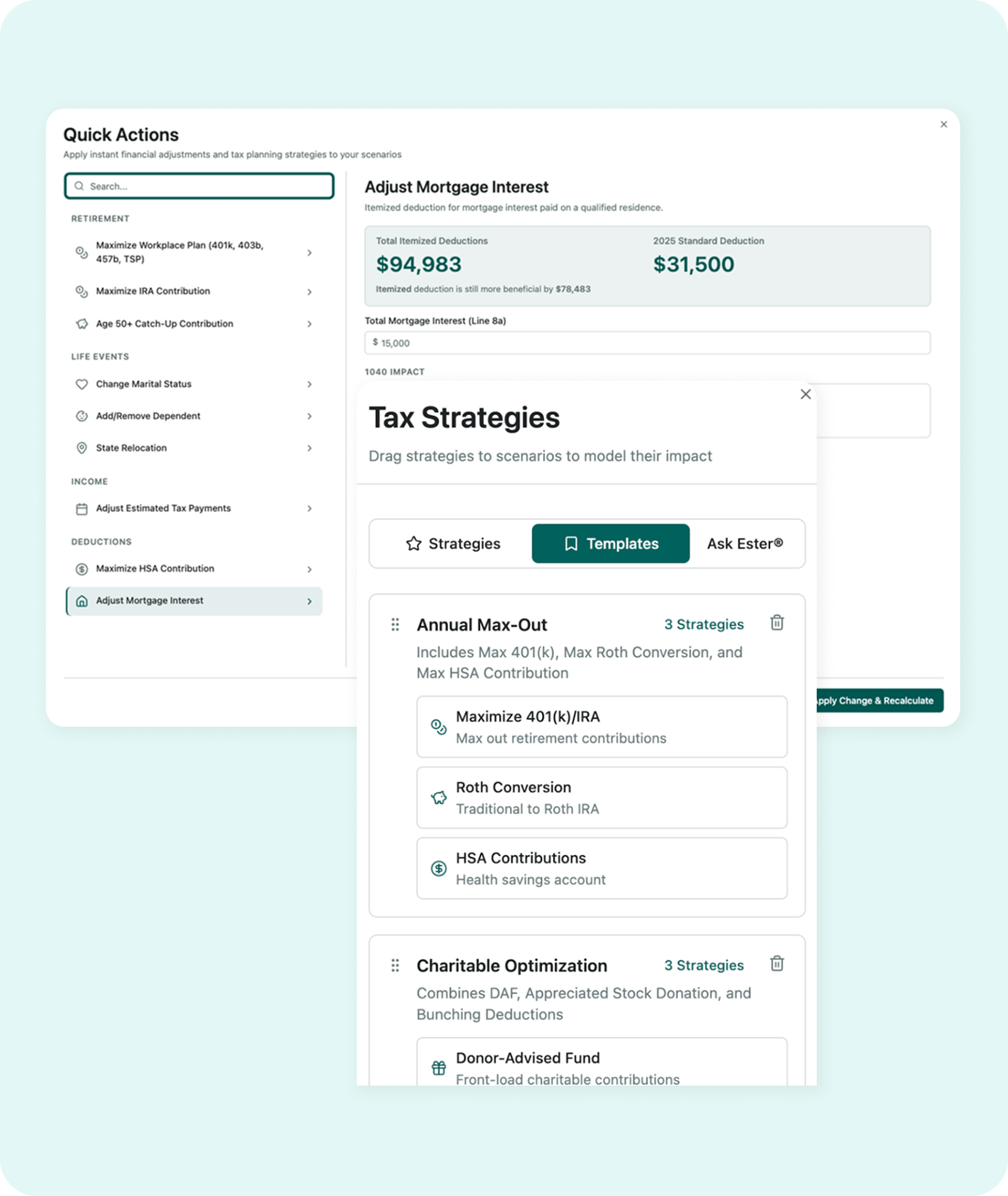

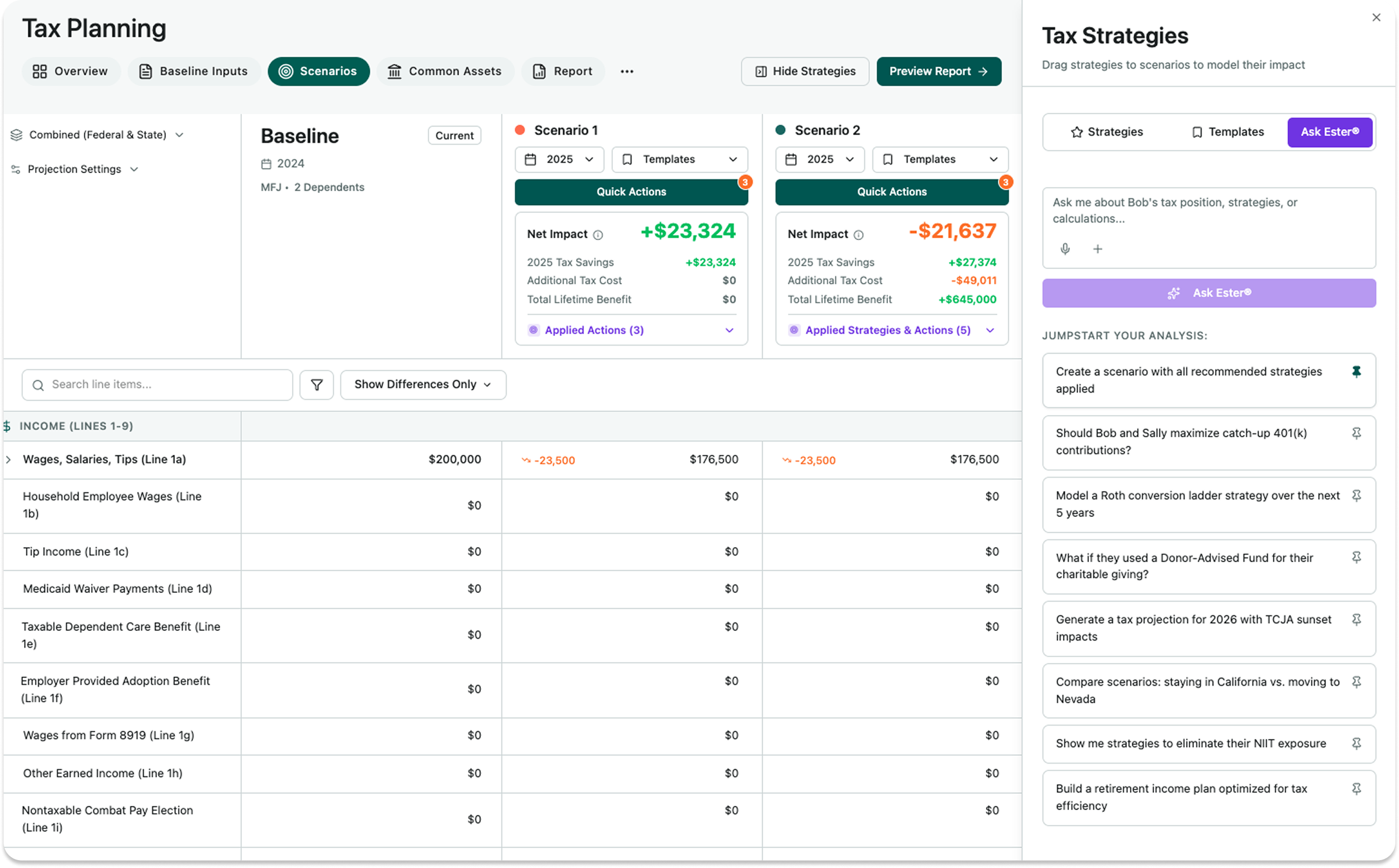

Turn complex tax codes into tangible savings. Apply high-impact strategies like Roth conversions or Capital Gains/Loss Harvesting with a tap. The system calculates an estimated tax savings figure, helping clients clearly see the potential impact of each recommendation.

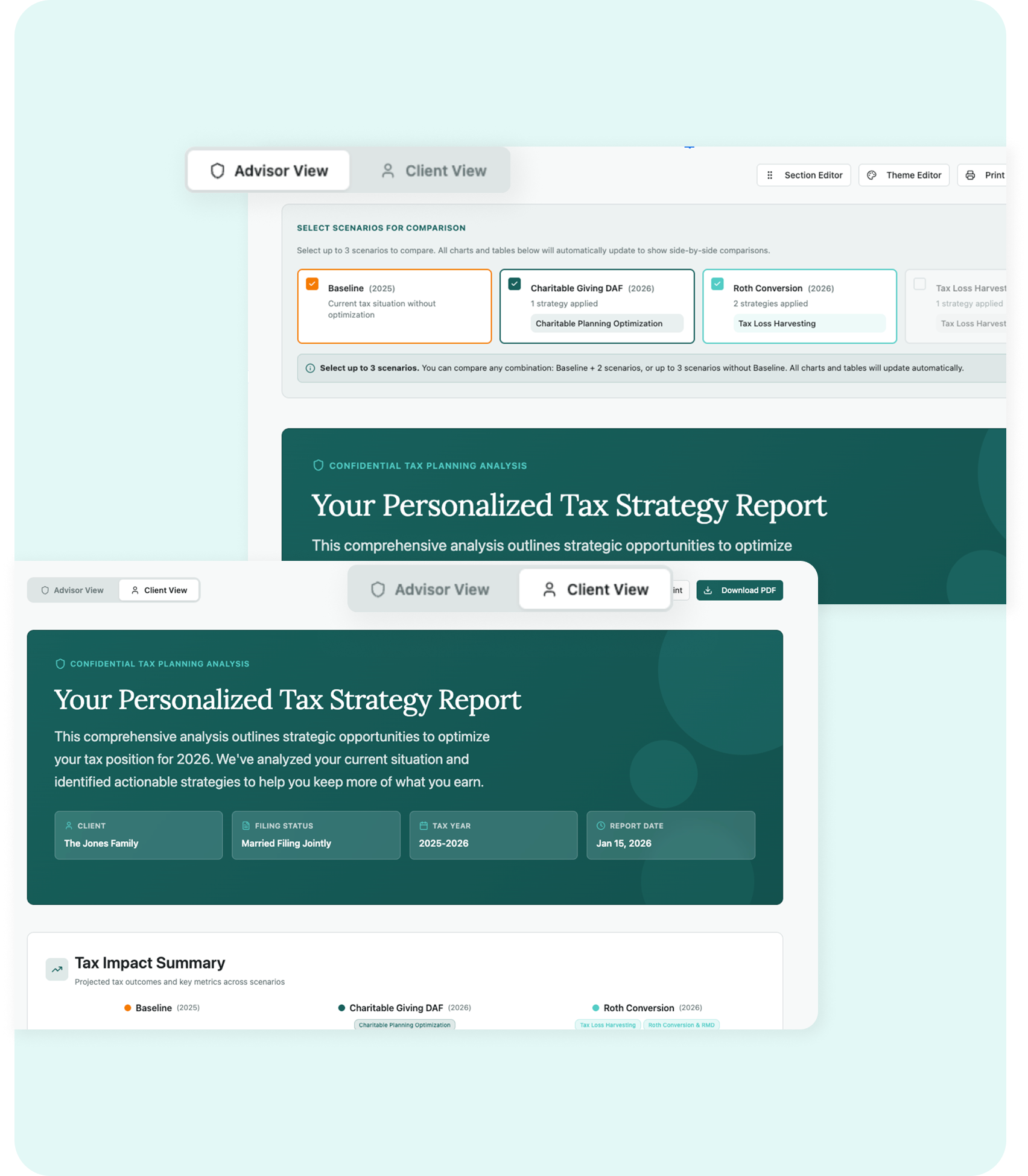

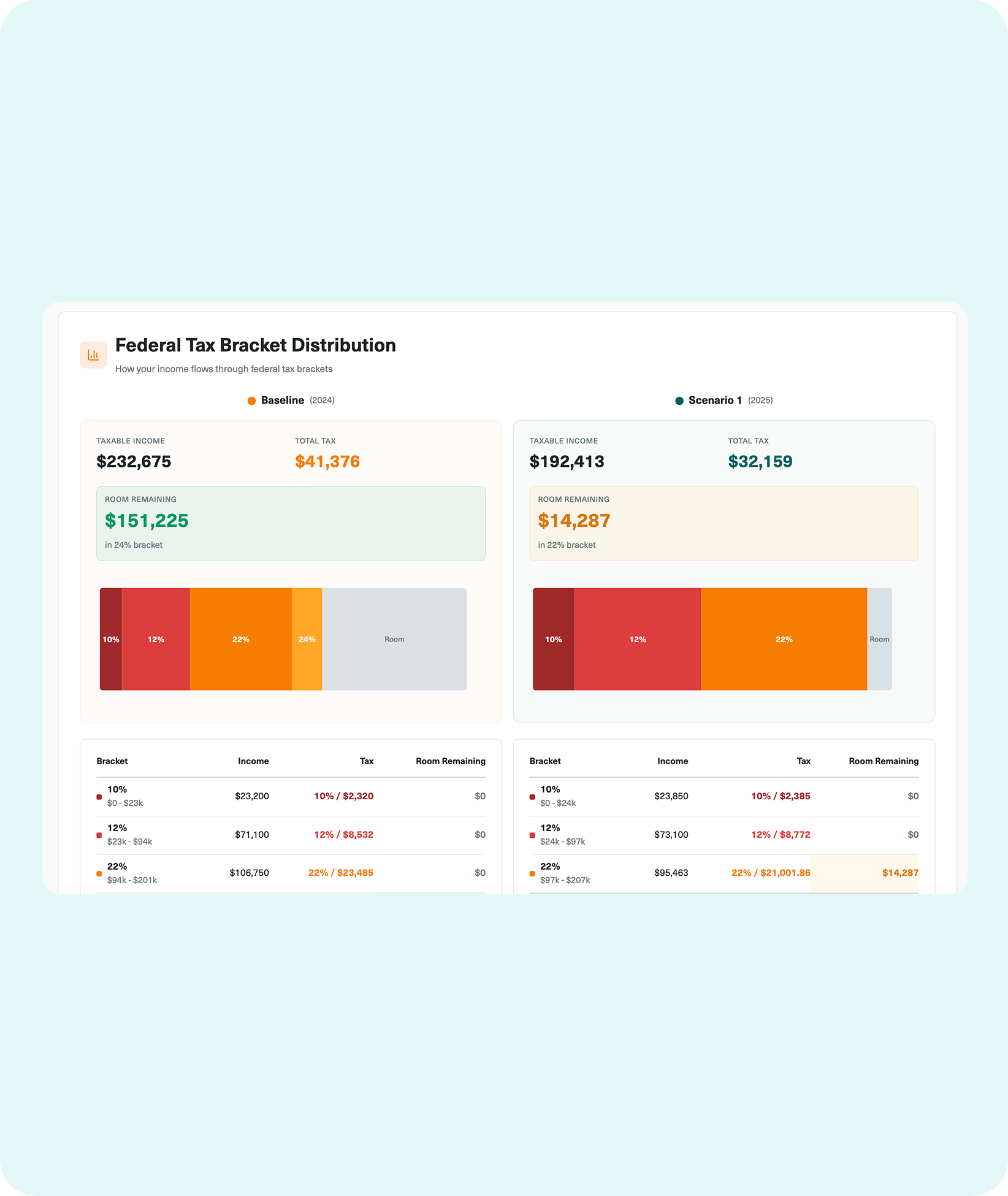

Compare the delta between up to four different scenarios in a clean, column view.

Toggle between a granular “Advisor View” for deep work and a polished “Client View” for the boardroom.

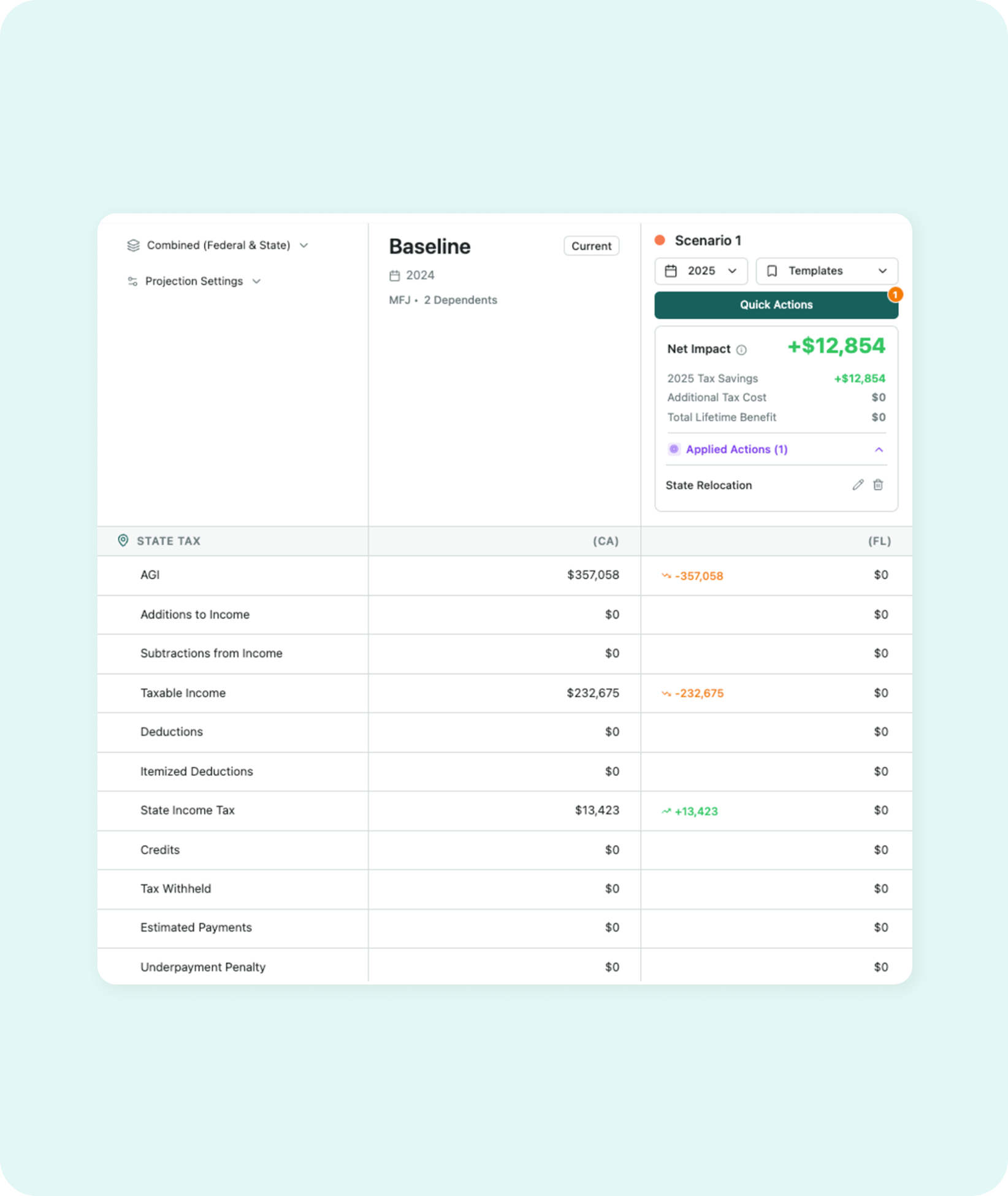

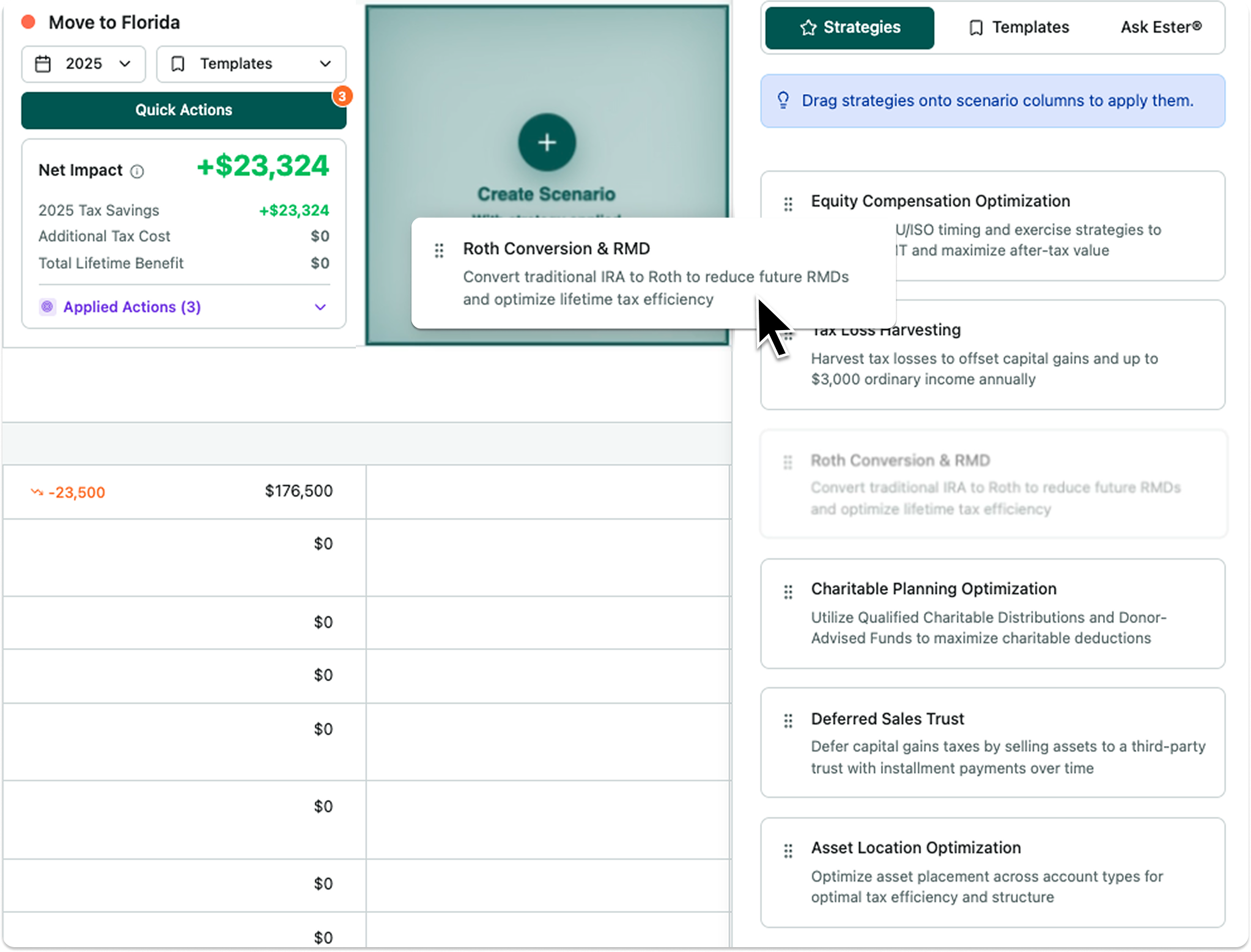

Your expertise shouldn’t stop at state lines. Handle complex State analysis with the same ease as federal returns. We clearly separate Federal vs. State observations, so you never miss a nuance.

Clients love to ask, “What if I moved to Florida?” Unlike other tools, we allow you to model a change of residence side-by-side against their current state in a single view.

Stop editing individual line items. Use Quick Actions to drag and drop strategies, like a Roth conversion or maxing out a 401(k), instantly. Have a standard playbook? Create a Template of strategies and apply it to any client in one click.

Frequently Asked Questions

Explore answers to the questions we hear most so you can move forward with peace of mind.