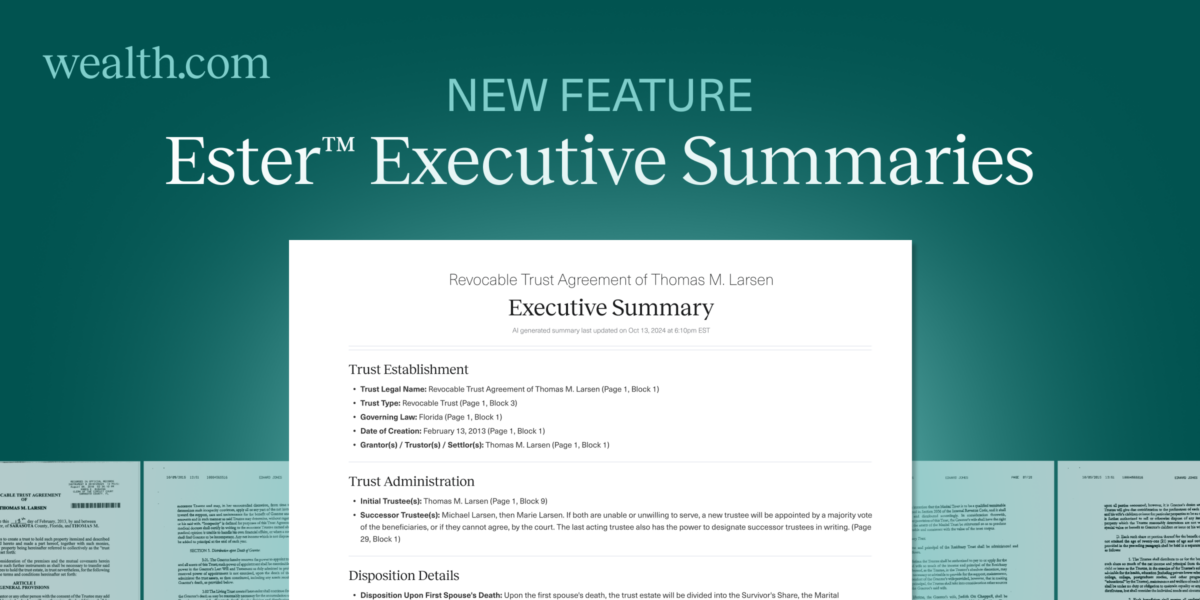

Wealth.com is excited to announce major enhancements coming to Ester®, our proprietary AI legal assistant tool. These updates include a brand new Executive Summary, which is optimized to recognize the decisions made in even the most complex estate planning documents and displayed in a concise, easy-to-read summary.

Executive Summaries for estate documents

Ester®, Wealth.com’s industry leading AI legal assistant, is already solving a critical bottleneck for advisors when it comes to helping clients with their estate plans. Reviewing existing estate plan documents to pull out relevant information—which can often be upwards of 60 or 70 pages—can take hours, if not days of manual work. But with Ester, advisors are able to upload their clients’ documents and, within seconds, get a summary of all the key information.

Now, advisors can also access an Executive Summary of clients’ estate planning documents that includes a link to the exact page where information was identified. This Executive Summary automatically provides built-in talking points to facilitate the conversation with clients and review key decisions.

The Executive Summary will be available for:

- NEW: Irrevocable Trusts (including GRATs, SLATs, ILITs, Dynasty Trusts, among others)

- NEW: Advance Health Care Directives

- NEW: Financial Powers of Attorney

- Revocable Trusts

- Last Will & Testaments (including Pour-Over Wills)

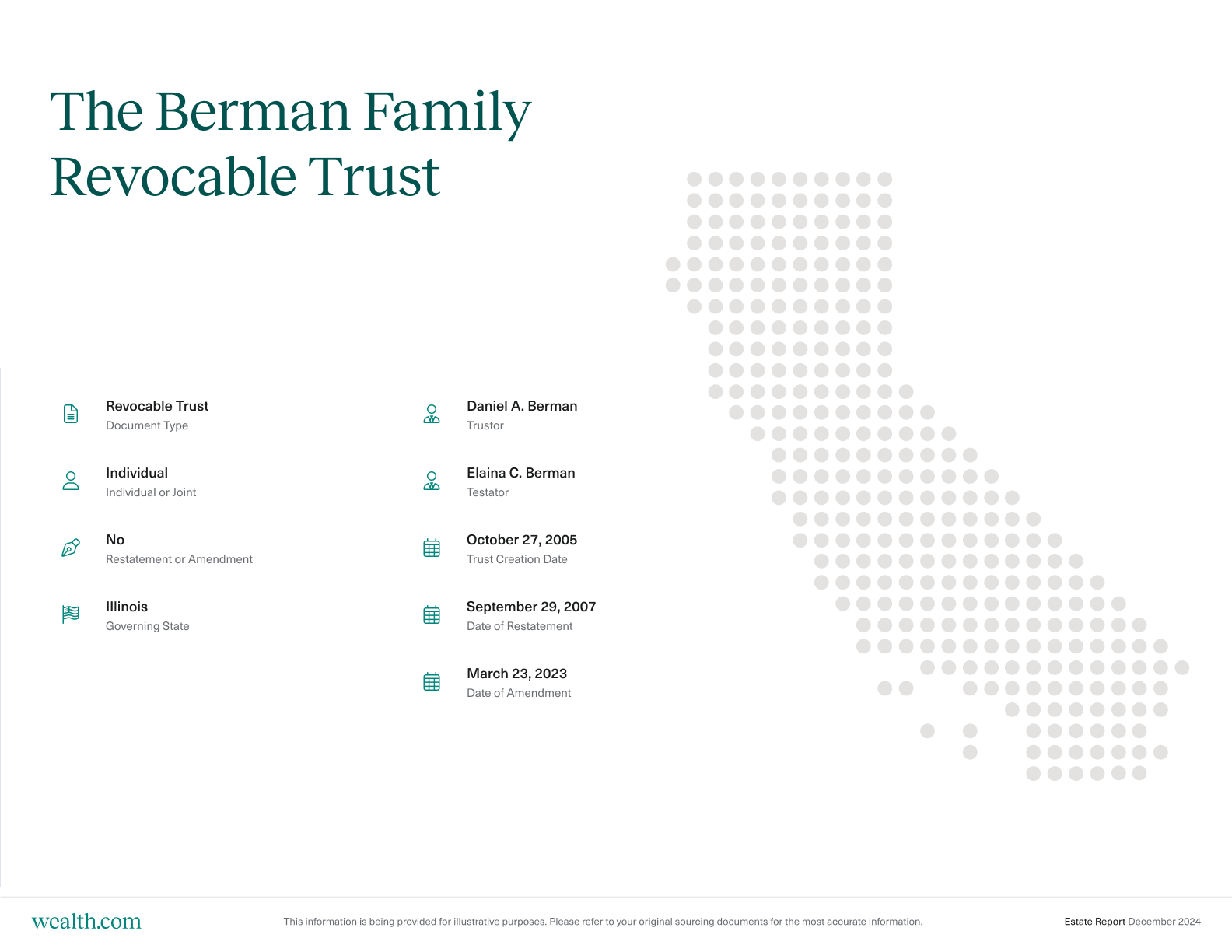

Redesigned Ester Visualizer Report

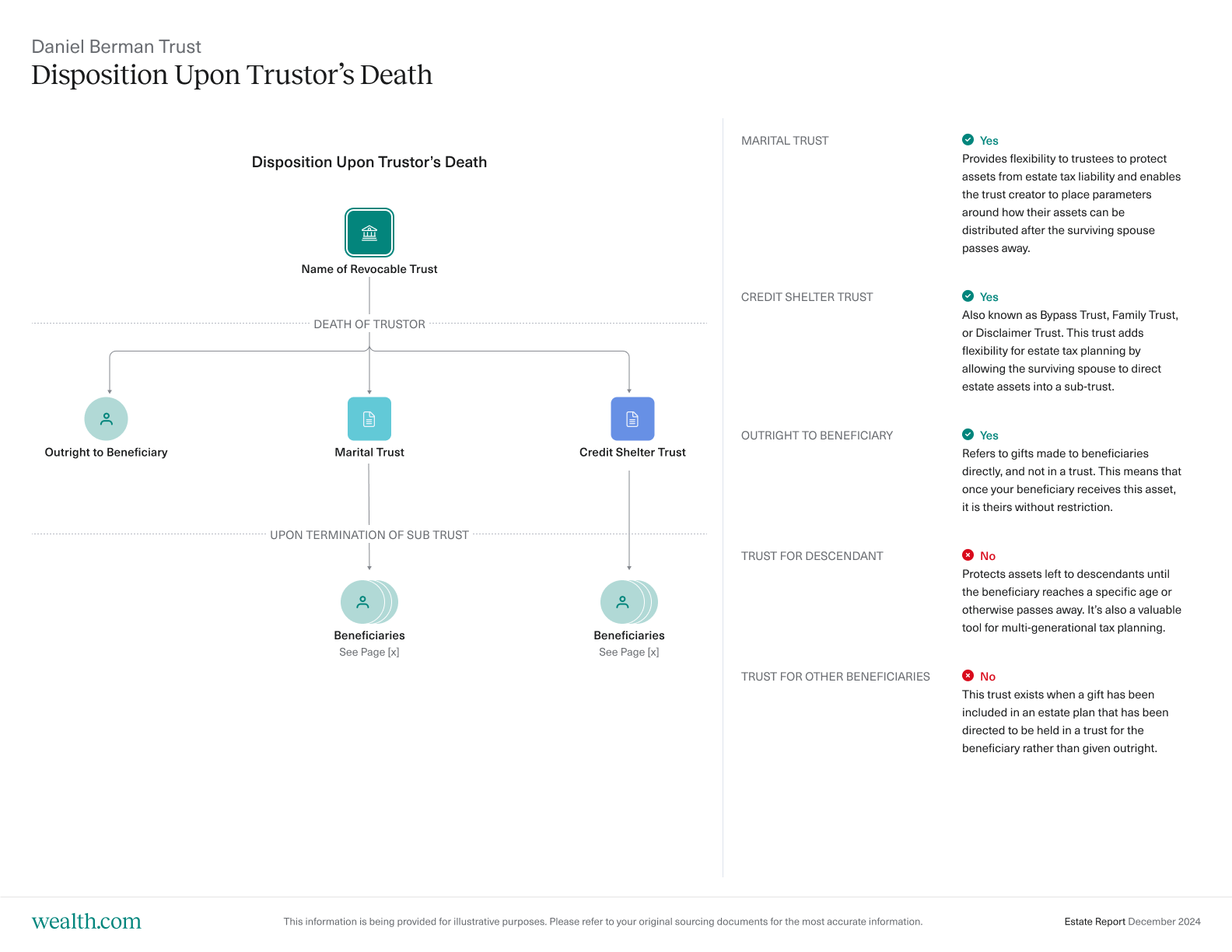

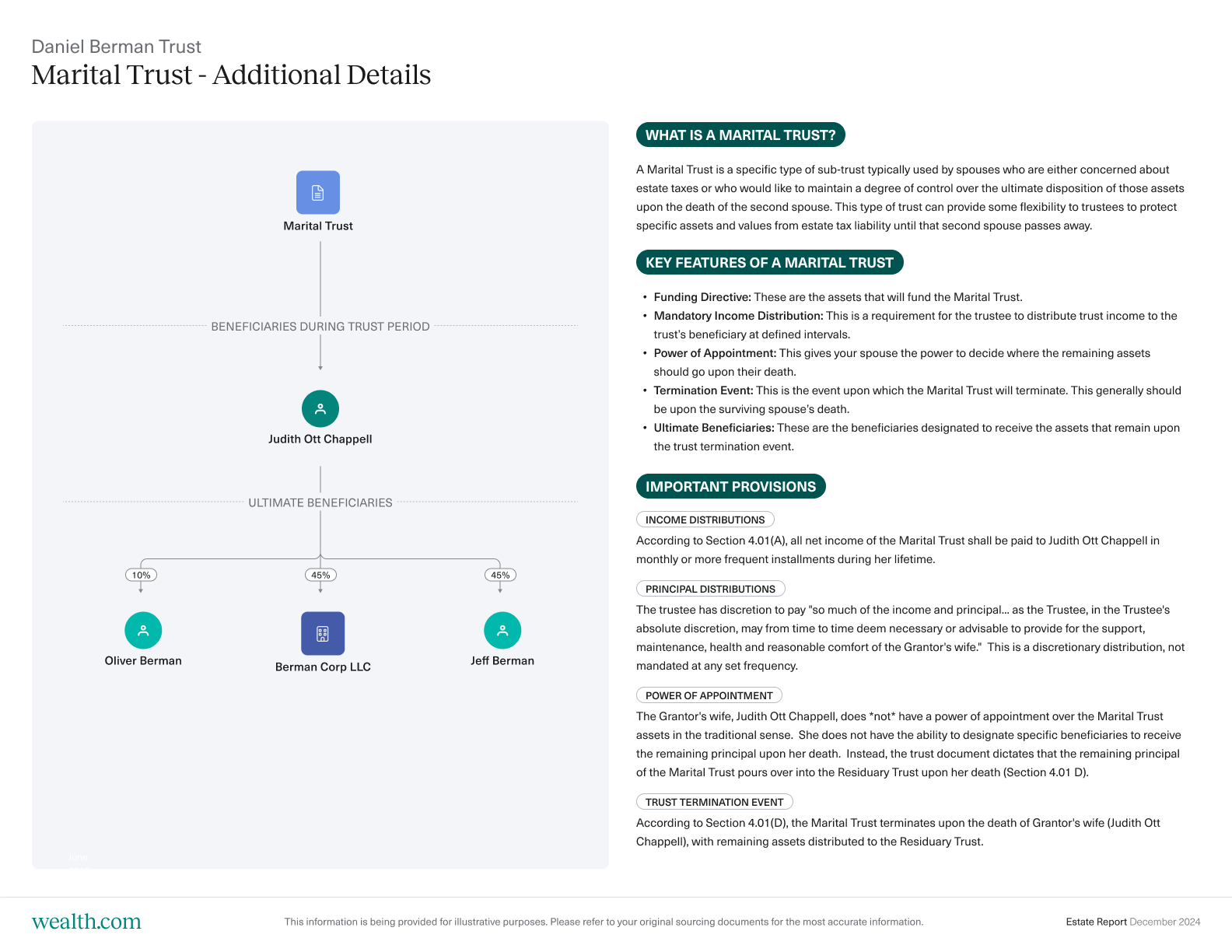

For Revocable Trusts and Last Will & Testament documents, the information that is pulled into the new Ester Executive Summary view is also fed instantaneously into a visualizer report. These distill the details of the extracted documents into visuals that clarify the complex details of the document. The new reports break down key people and entities identified in the client’s document, including grantors, trustees, executors and guardians, alongside how assets will be distributed and to whom, including recognizing income, principal and trust distributions.

Sample report pages:

Providing clarity on the complex for advisors and clients

Ester acts as your AI legal assistant, helping you to reduce hours of manual effort to deliver clients with clarity about their estate plans and unlock additional planning opportunities to progress forward with your client.

These new updates are currently being rolled out to new and existing Wealth.com customers over the coming weeks. To learn more about how Ester and Wealth.com can reimagine estate planning for your firm, book a personalized demo today.