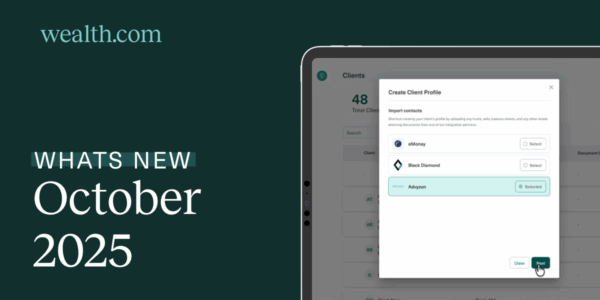

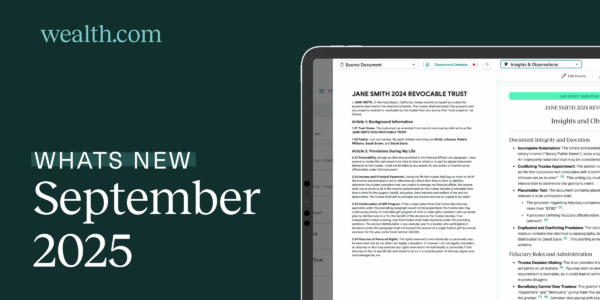

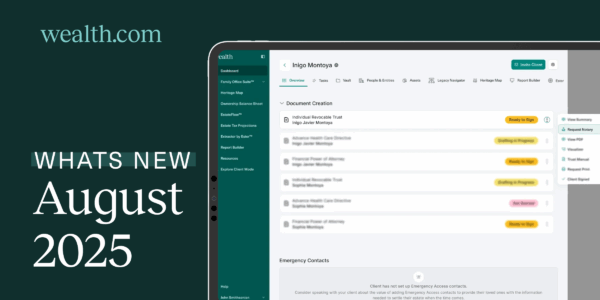

Key platform updates designed to streamline workflows, strengthen integrations, and help advisors deliver more client-ready reports this season.

Wealth.com Resources

Articles

Fresh thinking and timely perspectives from leaders shaping the future of wealth and legacy planning.

Content Type

All Articles Case Studies CFP Education Press & Media The Practical Planner Podcast Tools & Templates Webinars & Videos White Papers