Holiday gifting is one of the few “high touch” moments on the calendar that every client expects, yet few advisors use strategically. The right gift can quietly reinforce your value, signal that you understand what matters to a family, and open conversations about goals, legacy, and well-being.

Below is a curated list of thoughtful, modern ideas across a range of price points. Each is designed to feel personal, elevated, and aligned with a fiduciary, planning-forward mindset.

1. Charitable Giving Card in the Client’s Name

Ideal for: Philanthropically minded households, business owners, and clients who prefer “less stuff.”

Suggested range: Approximately $25 to $250, adjusted for your firm’s limits.

Where to buy:

Why it works

A charity gift card lets clients direct funds to causes they care about, which makes the gesture feel values-aligned rather than transactional. It reflects well on your practice because it frames generosity and impact as part of the planning conversation, not an afterthought. Clients often share with you why they chose a specific charity, creating a natural opportunity to discuss legacy planning, donor-advised funds, or structured giving strategies in the new year.

2. Gourmet Food Gift Box

Ideal for: Food lovers, multi-generational families, and clients you rarely see in person.

Suggested range: Wide range, from under $50 to premium boxes.

Where to buy:

Why it works

A curated food box feels celebratory, shareable, and easy for you to scale across a book of business. Services like Goldbelly ship regional specialties and restaurant-level experiences nationwide, which makes the gift feel more considered than a generic basket. When families enjoy it together, your name is associated with a moment of connection rather than simply a logo on a tin. For top households, you can tailor boxes to dietary preferences or hometown favorites, signaling that you remember the details.

3. Legacy Storytelling or Memoir Service

Ideal for: Long tenured clients, retirees, and family matriarchs or patriarchs.

Suggested range: Mid-tier, roughly $75 to $150.

Where to buy:

Why it works

Services like StoryWorth email weekly prompts, collect stories, and compile them into a printed book. Framed as “a way to preserve your family stories,” this gift aligns naturally with your role in helping clients protect both financial and non-financial legacies. It conveys that you see the client as a whole person, not just an account. Discussing the stories during future meetings can deepen multi-generational relationships and keep you top of mind with heirs who read the finished book.

4. Personalized Stationery or Note Cards

Ideal for: Executives, professionals, and clients who value thoughtful communication.

Suggested range: Typically $40 to $100 for a boxed set.

Where to buy:

- Personalized stationery at Minted

Why it works

A set of personalized stationery is both practical and elevated. It reinforces the idea that handwritten notes still matter, which complements the way many advisors nurture relationships. Minted and similar services offer high quality paper and modern designs, so the gift feels tailored rather than generic. When clients use the stationery to write to their own network, your name is associated with something they are proud to send.

5. Professional Family Photo Session Gift Card

Ideal for: Families with children, milestone years, or clients who have moved or downsized.

Suggested range: Premium, typically $250 and above, depending on the market.

Where to buy:

Why it works

Professional photos are something many families want but rarely prioritize. A photo session gift card can be framed as “capturing the people you are really planning for.” Services like Flytographer connect families with vetted photographers in hundreds of cities, which is especially helpful for clients who travel frequently. The resulting images may end up displayed at home for years, turning your gift into an ongoing reminder of the relationship.

6. Custom Photo Book or Legacy Album

Ideal for: Established clients, new grandparents, and families experiencing big life transitions.

Suggested range: Roughly $40 to $150 depending on size and format.

Where to buy:

Why it works

A gift credit for a premium photo book encourages clients to curate and print their memories instead of leaving them on phones. Artifact Uprising, for example, focuses on archival materials and modern design, which makes the finished books feel like true keepsakes. That pairs naturally with conversations about legacy, guardianship, and what clients want their families to remember. Offering to cover a book after a major life event, such as a wedding or birth of a grandchild, shows you are paying attention.

7. Mindfulness or Meditation App Subscription

Ideal for: High-stress executives, caregivers, and clients navigating major transitions.

Suggested range: Typically $50 to $100 for a one year gift subscription.

Where to buy:

Why it works

Gifting a mindfulness app says, “I care about your well-being, not just your balance sheet.” Both Calm and Headspace offer guided meditations, sleep content, and stress management resources that many clients will actually use, especially during a hectic holiday season. It reinforces the idea that your role includes supporting good decision-making, which is easier when clients feel rested and regulated.

8. Online Learning Membership for Personal or Professional Growth

Ideal for: Lifelong learners, entrepreneurs, and rising professionals.

Suggested range: Mid to premium tier, often around $100 to $200 annually.

Where to buy:

Why it works

An online learning membership aligns cleanly with the theme of growth. MasterClass, for example, bundles classes across business, leadership, creativity, and wellness that can complement your planning work in areas such as career transitions or business strategy. Invite clients to share what they are learning in your next review meeting. That keeps conversations future-focused and positions you as a partner in their broader aspirations.

9. Elevated Desk Set: Notebook and Pen Clients Will Actually Use

Ideal for: Business owners, professionals, and clients who still work full time.

Suggested range: Roughly $50 to $150 for a notebook and pen combination.

Where to buy:

Why it works

A well made notebook and pen set is something clients can use daily, which keeps your relationship subtly present in their workspace. Choosing neutral, timeless designs avoids anything that feels overly branded. This type of gift aligns with planning conversations where you encourage clients to capture goals, questions, or “parking lot” items between meetings. It conveys respect for their time and work, and it feels appropriate at a wide range of asset levels.

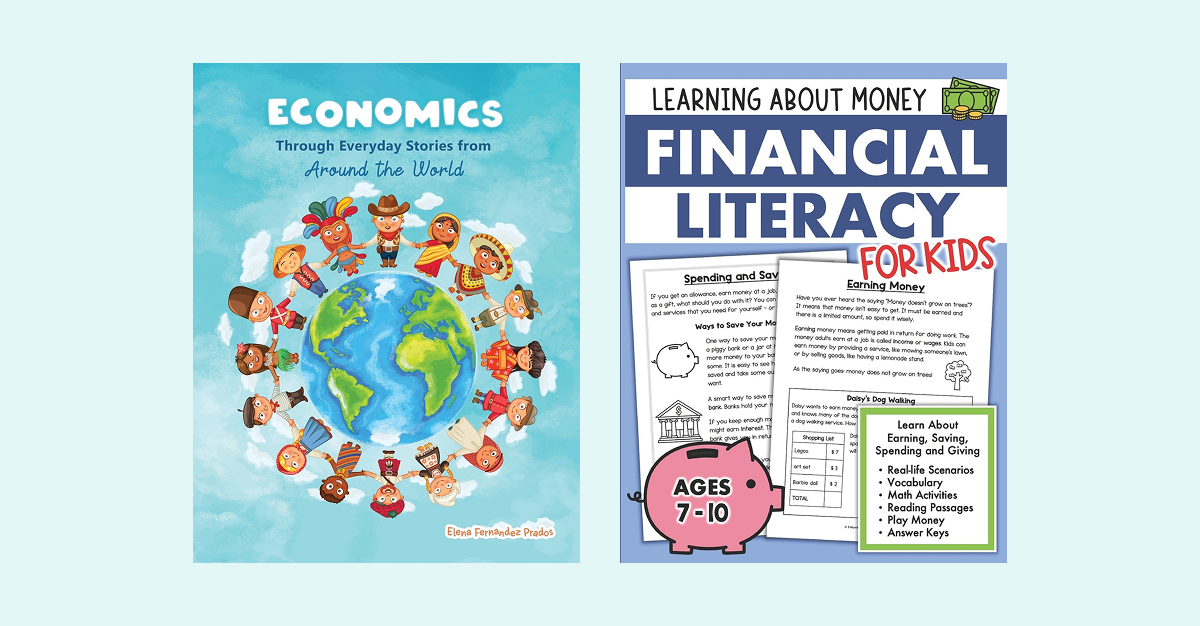

10. Financial Literacy Bundle for Children or Grandchildren

Ideal for: Multi generational planners, grandparents, and clients focused on legacy values.

Suggested range: Typically $30 to $100.

Where to buy:

Why it works

A small bundle that might include an age-appropriate money book, a savings jar, or a “first investment” themed journal shifts the holiday conversation toward financial literacy for the next generation. Sourcing books from services that support independent bookstores, such as Bookshop.org, can also appeal to socially conscious clients. You can follow up by offering a short family meeting on basic investing or budgeting, which positions you as a resource for the entire family, not just the primary account holder.

11. Local Experience or Dining Gift Card

Ideal for: Busy professionals, new parents, or clients who value time together more than physical items.

Suggested range: Flexible, often $100 to $300 dollars for a meaningful outing, adjusted to your policy limits.

Where to buy:

Why it works

Experiences create memories and give clients something to look forward to in the new year. A thoughtfully chosen restaurant or a flexible travel card communicates that you want them to enjoy the wealth they have worked to build. For households that travel frequently or split time between locations, an experience-centric gift also aligns with conversations about lifestyle planning. When you reference the outing at your next meeting, it invites a more personal recap than a traditional check-in.

12. Handwritten Year in Review Note with a Small, Personal Keepsake

Ideal for: All clients, especially when paired with other gifts for top households.

Suggested range: Very budget-friendly; often under $25 per client, depending on the keepsake.

Where to buy:

- Personalized ornaments or small keepsakes on Etsy

Why it works

Even when you opt for more substantial gifts, a handwritten note summarizing the year, acknowledging key milestones, and expressing appreciation is often what clients remember most. Pairing it with a small, meaningful object such as a personalized ornament or simple desk item adds a tangible reminder without feeling excessive. This is particularly helpful when you need a compliant, low value option that still feels personal and aligned with your brand.

13. National Parks Annual Pass

Ideal for: Clients who enjoy traveling, being outdoors, hiking, and recreational activities.

Suggested range: $85 per client ($80 for the pass, $5 for processing fees).

Where to buy:

Why it works

An annual pass to the U.S. National Parks system invites clients to create experiences with the people they care about. It aligns naturally with conversations about using wealth for time, travel, and shared memories. The pass covers entrance fees at thousands of federal recreation sites for a year, so it feels generous without being flashy.

14. Virtual Cooking Class

Ideal for: Couples, families, and busy professionals who want a “night in” that still feels special

Suggested range: Varies, from a pasta-making class for $29 to premium experiences starting at $185 per person.

Where to buy:

Why it works

A virtual cooking class brings families or couples together for a shared experience at home. Providers offer digital gift vouchers that can be redeemed for live or on demand classes, often focused on specific cuisines or techniques. This type of gift is memorable and story-worthy, which means clients are likely to mention it in future conversations. Framing it as “a night in” that they can schedule on their terms respects their time and creates positive association with your practice as a source of enjoyable, low friction experiences.

15. Custom Illustrated Family Portrait

Ideal for: Households that enjoy personalized, meaningful gifts, clients who recently experienced a major life event like a new baby, wedding, or moving into a new home

Suggested range: Budget-friendly; $10-$100

Where to buy:

Why it works

A custom family portrait or illustration, often created from a favorite photo and including pets, becomes a highly personal piece of home decor. Many artists let clients customize outfits, poses, and names, turning the illustration into a keepsake. This gift says very clearly that you see the family behind the balance sheet. It fits beautifully with estate and legacy planning since it will often hang in a central spot at home and be seen by multiple generations, quietly keeping your relationship in the background of family life.

A Brief Compliance Reminder

This guide is for general informational purposes. It is not legal, tax, or compliance advice. For advisors affiliated with broker-dealers, gifts provided in connection with business are typically subject to limits under your firm’s policies and may also be limited by rules such as FINRA Rule 3220, often referred to as the “Gifts Rule.” The current version of Rule 3220 generally prohibits giving more than $100 per recipient per year in business-related gifts and requires firms to keep specific records.

FINRA has proposed increasing that limit, and the Securities and Exchange Commission is still reviewing the proposal, including a potential move toward a higher cap per person per year. Your firm may also apply stricter policies than the rule itself.

Practical guardrails to keep in mind:

- Confirm your firm’s written policy on gift limits, aggregation, and approval workflows.

- When in doubt, favor lower-value, widely scalable gifts that are clearly business-related or de minimis.

- Keep simple records showing what you sent, to whom, and the approximate value.

- When you are an RIA or dual registrant, coordinate across entities so gifts are treated consistently.

When you are unsure, your compliance team is the best source of current, firm-specific guidance.

Using Holiday Gifting to Reinforce Your Brand

Holiday gifting is most effective when it is intentional. The goal is not to “wow” clients with price, but to choose gestures that quietly reinforce who you are as an advisor.

- Gifts that highlight family, memory, and legacy support your positioning as a long-term planner.

- Gifts centered on learning, wellness, and experiences underscore your role as a partner in their whole life, not just their investments.

- Thoughtful personalization, even at modest price points, signals that you listen carefully and remember what matters.

When you select gifts through that lens, each package or email is another touchpoint in a consistent client experience. Over time, that consistency builds familiarity and trust, which is ultimately more valuable than any single gift.