Many Millennial clients view estate planning as something they can address “later.” They may be building careers, raising young children, buying homes, or launching businesses, yet formal planning often sits at the bottom of their financial to-do list.

Advisors hear variations of the same refrains repeatedly:

- “I am still young. I do not need a will yet.”

- “We are not wealthy enough for an estate plan.”

- “My partner knows what I want. That is enough for now.”

At the same time, Millennials are increasingly holding meaningful assets and decision-making rights that require structure. This includes equity compensation, concentrated employer stock, early-stage business interests, digital property, and young children who would require guardianship.

The misconception that estate planning is only for older or high-net-worth individuals can leave significant gaps. Advisors are in a strong position to correct that narrative and show next-generation clients that planning is about control, clarity, and protection of the people and values they care about most.

Why Estate Planning Matters for Millennials

Millennial clients often have complex profiles, even if their liquid net worth is still growing. Planning matters whenever there are people who depend on them, assets that need direction, or decisions that would otherwise default to state law.

Consider these common scenarios.

New parenthood

A couple in their early thirties has a toddler and another child on the way. They have life insurance and retirement accounts, but no will and no named guardian. If one or both parents die unexpectedly, family members may disagree over who should care for the children. A court will decide, and the process may be slow and emotionally draining.

Long-term unmarried partners

A client has lived with a partner for eight years. They share a home, but the deed and most accounts are in one person’s name. Without an estate plan, the surviving partner may have no legal right to remain in the home or to inherit assets, even if that was the clear intent.

Equity compensation and employer stock

A Millennial tech employee accumulates restricted stock units and stock options at a fast growing company. They assume everything will automatically transfer to their spouse if something happens. In reality, outdated beneficiary designations, plan rules, or lack of coordination with their will can lead to unintended outcomes or delays.

Entrepreneurial ventures and side businesses

A client runs an online store and holds intellectual property, trademarks, and vendor contracts. Without planning, it is unclear who can access business accounts, manage inventory, or sell the enterprise if the owner is incapacitated. Value that took years to build may quickly erode.

Blended families

A Millennial remarried parent has children from a prior relationship and a new baby with a current spouse. Without explicit instructions, state intestacy rules may not align with their intent to provide for all children and support the current partner in a balanced way.

Student loan and debt considerations

Some private student loans and personal debts may not be discharged at death, affecting co signers or spouses. Planning helps clarify how these obligations would be handled and how to protect the financial position of surviving family members.

Digital asset control

Clients store photos, creative work, and financial value across cloud services, social platforms, and crypto wallets. Without documented access and clear instructions, families may be locked out of accounts or lose digital value permanently.

Medical directives and decision making

A young professional has strong views about medical care and end of life decisions. If they do not have a health care proxy or advance directive, loved ones may face painful uncertainty, and medical decisions will default to statutory hierarchies rather than personal intent.

These situations are not theoretical. They play out in probate courts and family disputes every day. The role of the advisor is to translate these risks into practical, values based conversations that resonate with Millennial clients.

Advisor Talking Points and Conversation Starters

Advisors can normalize estate planning by integrating it into routine reviews and life event check-ins. The goal is to focus on clarity and education, not fear.

Here are conversation starters that support that tone:

- “If something unexpected happened tomorrow, who would you want to make medical decisions for you, and have you documented that preference anywhere?”

- “If you and your partner were both unavailable, who should care for your children, and would a court know that from your current documents?”

- “Do you know who would have legal access to your digital accounts, photos, or crypto wallets if you were not here to log in?”

- “Your equity comp and RSUs may not transfer the way you assume without updated documentation. Have you reviewed how those benefits fit into your broader estate plan?”

- “How would you want your partner or children supported financially if you were not here, and have you put instructions in place to make that happen?”

- “You have invested a lot of energy into your business. If you were unable to run it for six months, who could legally step in and make decisions?”

- “You mentioned causes you care deeply about. Would you like some portion of your estate or future liquidity events to support those organizations?”

- “Right now, state law has a default plan for your assets and decisions. Would you like to design your own plan instead?”

- “We review your investments regularly. I would like to do the same for your estate documents so you stay aligned with your goals.”

- “What would peace of mind look like for you when it comes to your family’s financial future?”

These prompts open the door to deeper dialogue without relying on worst case scenarios or scare tactics. Advisors can use these prompts to surface goals, family dynamics, and planning gaps. Legal advice and document drafting belong with an estate planning attorney or attorney supported solution.

How Advisors Can Reframe the Value of Planning

Millennial clients respond well when estate planning is positioned as part of their overall life design. Advisors can:

- Present planning as a tool for control, not fear; clients are choosing who makes decisions and how their assets support the people and causes they care about.

- Emphasize that a thoughtful plan reduces avoidable legal burdens for loved ones, which aligns with many clients’ desire to “not leave a mess.”

- Connect estate planning to milestones Millennials already prioritize, such as protecting children, securing a home, formalizing a long term partnership, or documenting ownership in a side business.

- Frame planning as a pillar of financial wellness, in the same category as emergency funds, insurance, and retirement savings.

When clients see estate planning as an extension of the work they are already doing with their advisor, the process feels more approachable.

Practical Tips for Advisors During These Discussions

Advisors can improve engagement and follow-through by making the process concrete and manageable.

Practical mini checklist for an estate planning conversation

- Confirm life stage details: children, partner status, business interests, major assets.

- Ask one or two open questions from the list above to surface priorities.

- Identify the most pressing gaps, such as guardianship or lack of a health care proxy.

- Outline a simple sequence, for example: “First, we will confirm beneficiaries; next, we will establish key documents; then we will revisit annually.”

- Agree on clear next steps, including introductions to legal resources or a digital planning platform.

Additional best practices:

- Tailor examples to the client’s life stage and values, for instance focusing on guardianship for new parents or business continuity for entrepreneurs.

- Emphasize flexibility and remind clients that plans can be updated as careers, families, and assets evolve.

- Bring both partners into the conversation early so each person understands the plan and feels ownership of the decisions.

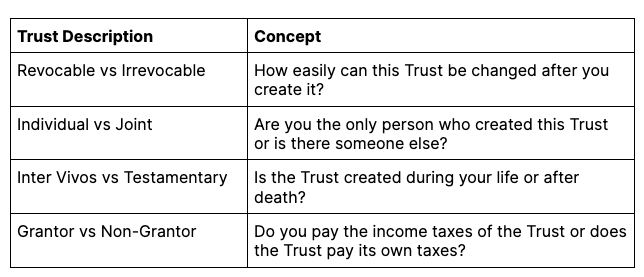

- Use simple visuals or checklists to break down the components of a plan, such as wills, trusts, powers of attorney, and directives.

- Introduce estate planning during natural transition moments such as job changes, stock vesting events, home purchases, or the birth or adoption of a child.

Why Technology Matters for Next Gen Clients

Millennial clients are accustomed to integrated digital experiences in banking, investing, and day to day life. They expect clarity, transparency, and relatively quick execution. Estate planning that relies solely on paper forms, long delays, and opaque processes can feel out of step.

Modern estate planning platforms can help close that gap. They typically offer:

- Guided workflows that reduce friction, translate legal concepts into plain language, and help clients identify which documents they need.

- Digital document creation with real time visibility into progress, so clients can see where they are in the process and what remains outstanding.

- Secure collaboration environments where advisors, attorneys, and clients can share information without email chains and version confusion.

- Mobile-friendly experiences and intuitive interfaces that meet clients where they already manage much of their financial life.

- Clear compliance features and audit trails that document activity, support fiduciary oversight, and reinforce trust.

For advisors, using technology in this area is not about replacing professional judgment. It is about making the planning process more accessible and aligned with how next-generation clients already interact with financial services.

How Wealth.com Complements the Advisor’s Role

Platforms such as Wealth.com are designed to bring financial strategy and legal structure into closer alignment. When advisors integrate a modern estate planning tool into their practice, several benefits often follow.

- Attorney-supported workflows help ensure that documents reflect current legal standards and that clients receive appropriate legal guidance while the advisor focuses on financial strategy.

- Collaborative tools allow advisors to stay involved, from initial education through implementation and ongoing updates, without needing to manage every legal detail themselves.

- Centralized digital storage and organization of estate documents reduce the risk that critical paperwork is lost or outdated, and make it easier to revisit the plan as life changes.

- Time savings result from simplified data gathering and document preparation, which can free advisors to focus on higher-value planning discussions.

- The overall client experience feels more modern and consistent with other digital financial tools, which is especially important when serving Millennials and other next-generation stakeholders.

In this model, the advisor remains the trusted guide who frames the “why” behind planning and helps clients connect estate decisions to their broader financial objectives. Wealth.com functions as an infrastructure layer that supports efficient, compliant, and understandable execution.

Millennial clients may not always see estate planning as urgent, but many already have the relationships, responsibilities, and assets that make planning essential. Advisors who introduce these conversations early, in a calm and values-based way, can help clients avoid unnecessary complexity later and build deeper trust in the process.

By combining clear education, practical examples, and technology-enabled tools such as Wealth.com, advisors can offer an estate planning experience that aligns with next-generation expectations for simplicity, transparency, and speed. Starting these discussions now, rather than waiting for a crisis or major life event, positions both clients and advisors for a more secure and intentional future.