2024 was a groundbreaking year for wealth.com, revolutionizing how wealth managers and estate planning come together through innovative technology. As the Great Wealth Transfer continues, estate planning has become essential for advisors aiming to elevate client satisfaction and engage the next generation.

Our success is thanks to our growing network of wealth management and advisor partners who trust in the power of estate planning and wealth.com’s ability to deliver for them and their clients.

To our clients, partners, and the wealth management community we connected with: thank you for making 2024 unforgettable. The entire wealth.com team is dedicated to continually innovating and improving the estate planning experience, and we can’t wait to show you what we’re working on in 2025.

First, here’s a look back at our highlights and accomplishments from the past year:

2024 was a year of innovation, recognition and growth

The wealth.com team hit the ground running in 2024. We doubled down on innovation, consistently releasing product features to improve the estate planning process for advisors and having life-changing impacts for their clients.

Our hard work was rewarded with recognition from industry leaders and wealth.com was firmly established as the leading digital estate planning platform.

We also attended and spoke at events across the country, worked closely with fantastic partners within the industry, grew our Practical Planner podcast and more—culminating in a Series A led by Google Ventures and other leading tech investors.

Top product announcements

Family Office Suite™

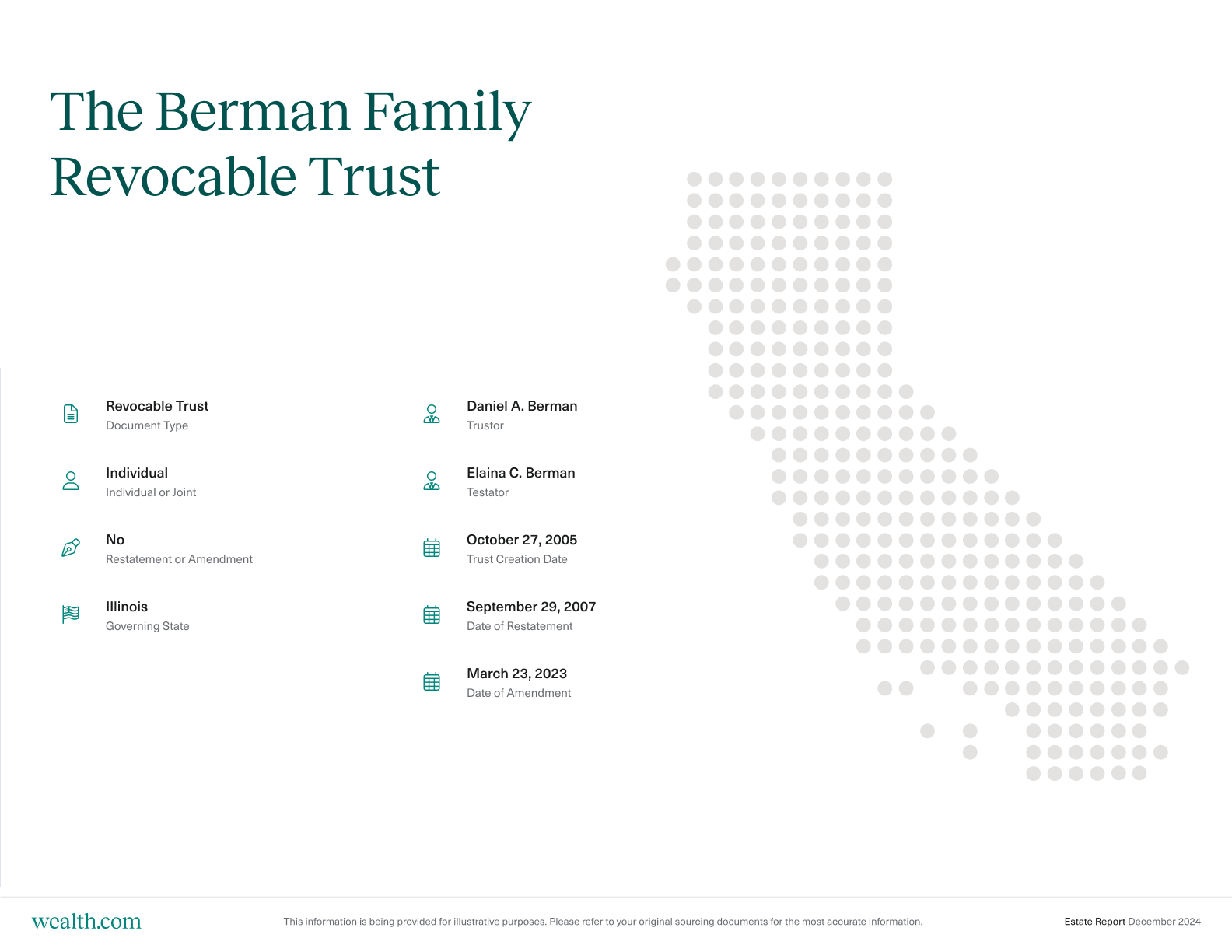

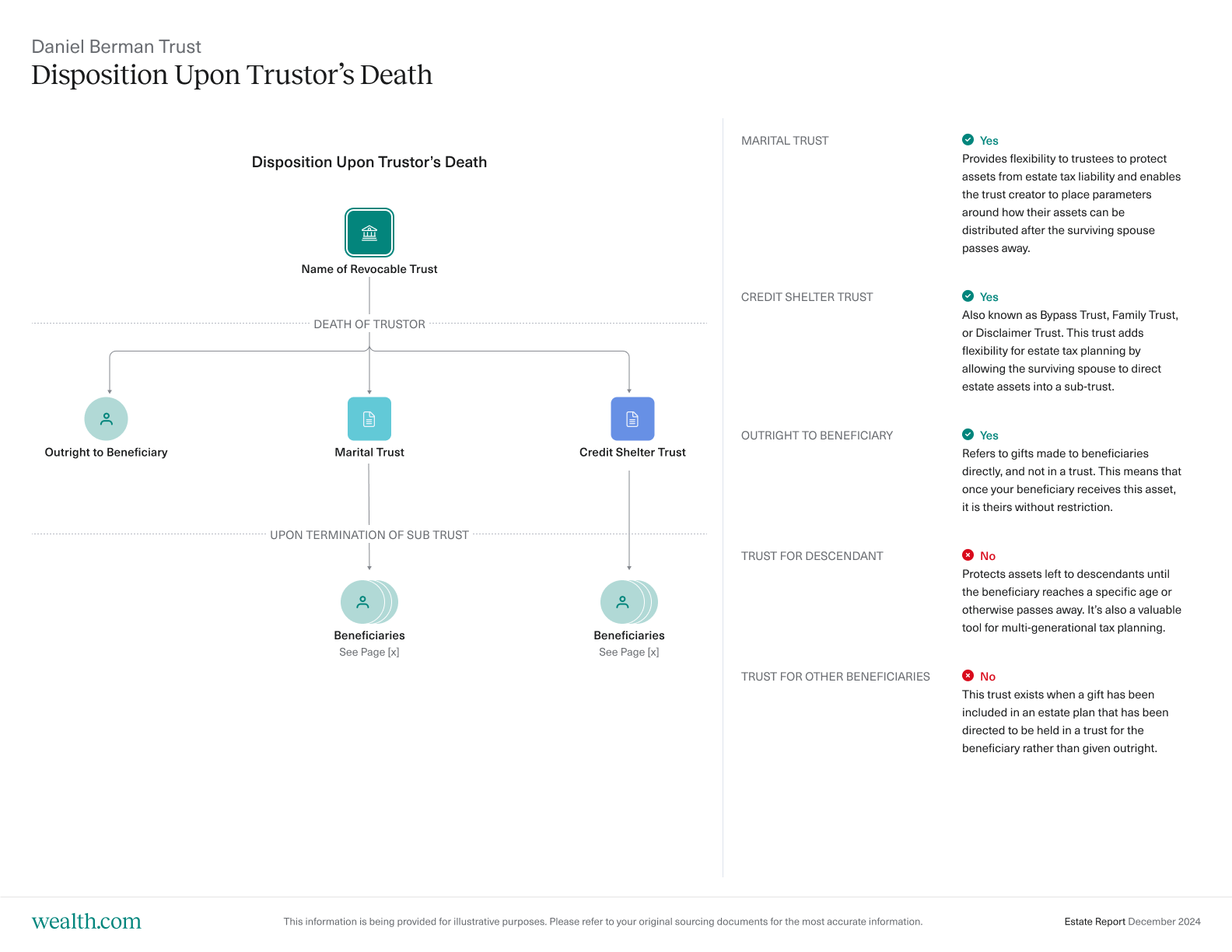

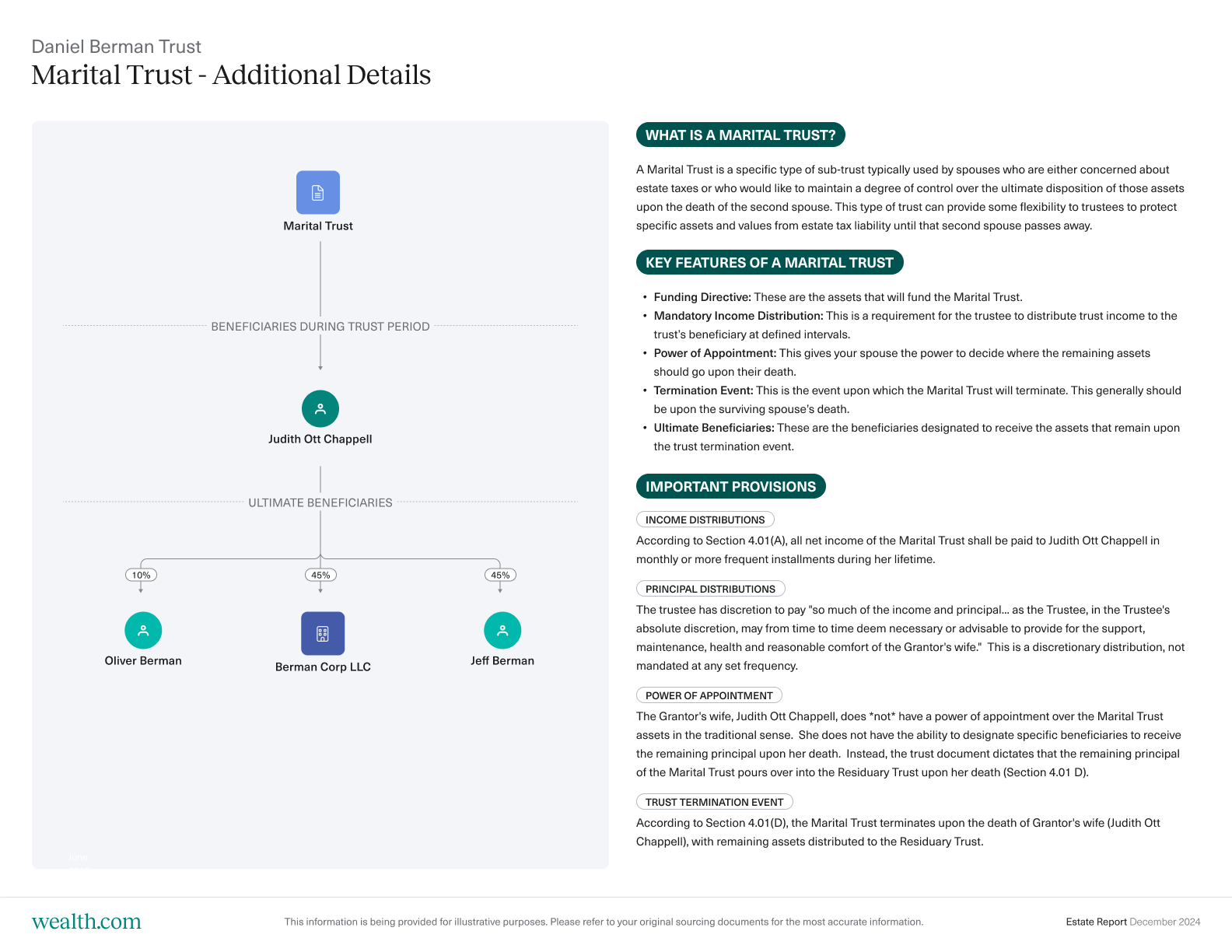

Our Family Office Suite™introduced the industry’s first collection of estate management of technologies for highly complex estates. Since released, it has enabled advisors to streamline estate management by seamlessly collecting, structuring and visualizing data from a client’s estate plan—and delivering it in all in elegant, customizable reports to enhance wealth transfer conversations.

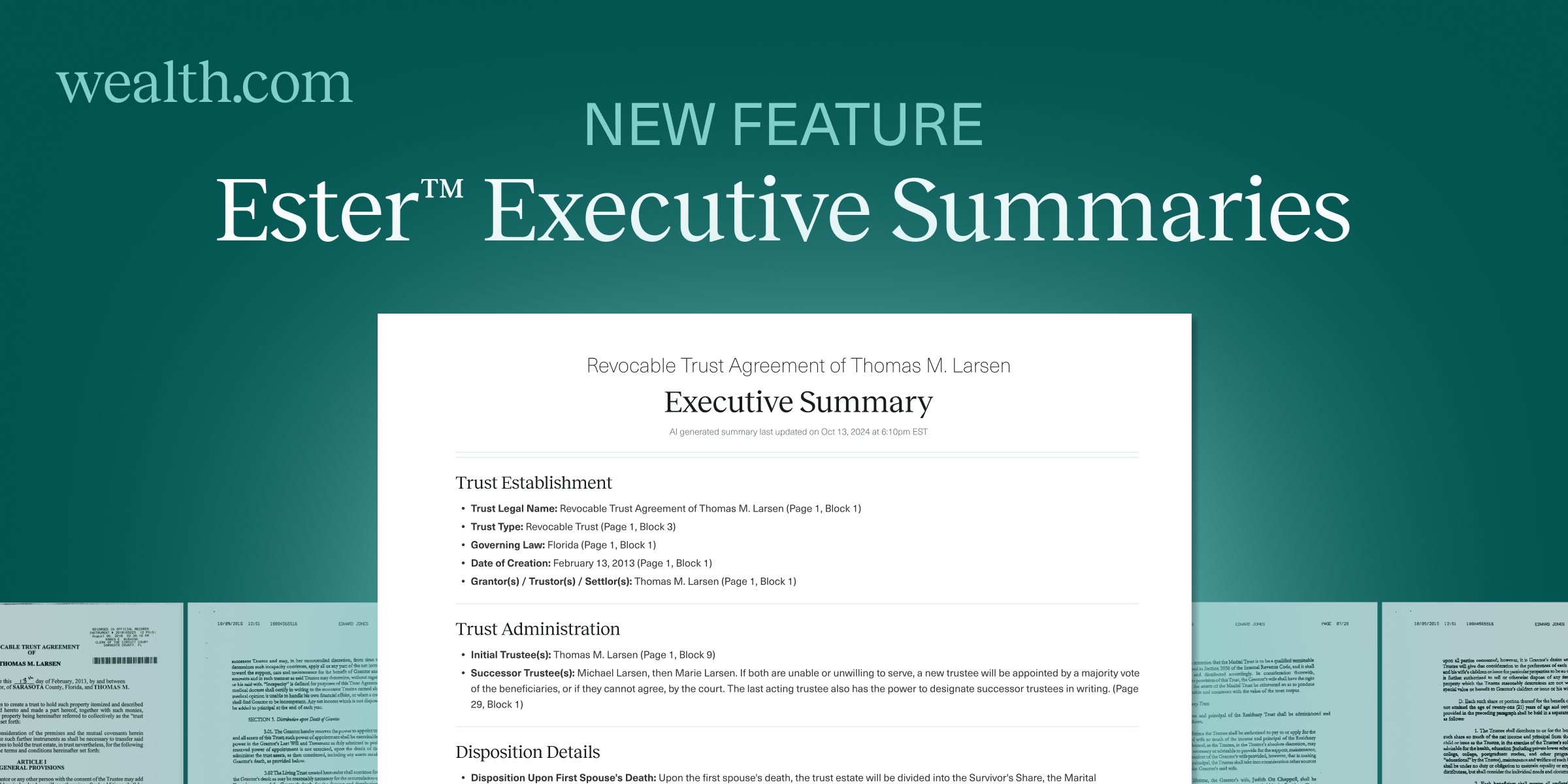

Ester™ AI enhancements

We invested heavily in Ester™, our AI legal assistant tool, that enables advisors to work smarter by automating manual processes, namely reviewing estate planning documents. This year we launched:

- Executive Summaries: Single-page, client-ready summaries of documents.

- Automatic Contact Card creation for key decision makers and others named in documents, such as trustees and family members.

- Expanded extraction capabilities to new document types, including Irrevocable Trusts (GRATs, ILITs and SLATs), Advanced Health Care Directives and Financial Powers of Attorney.

Document Creation improvements

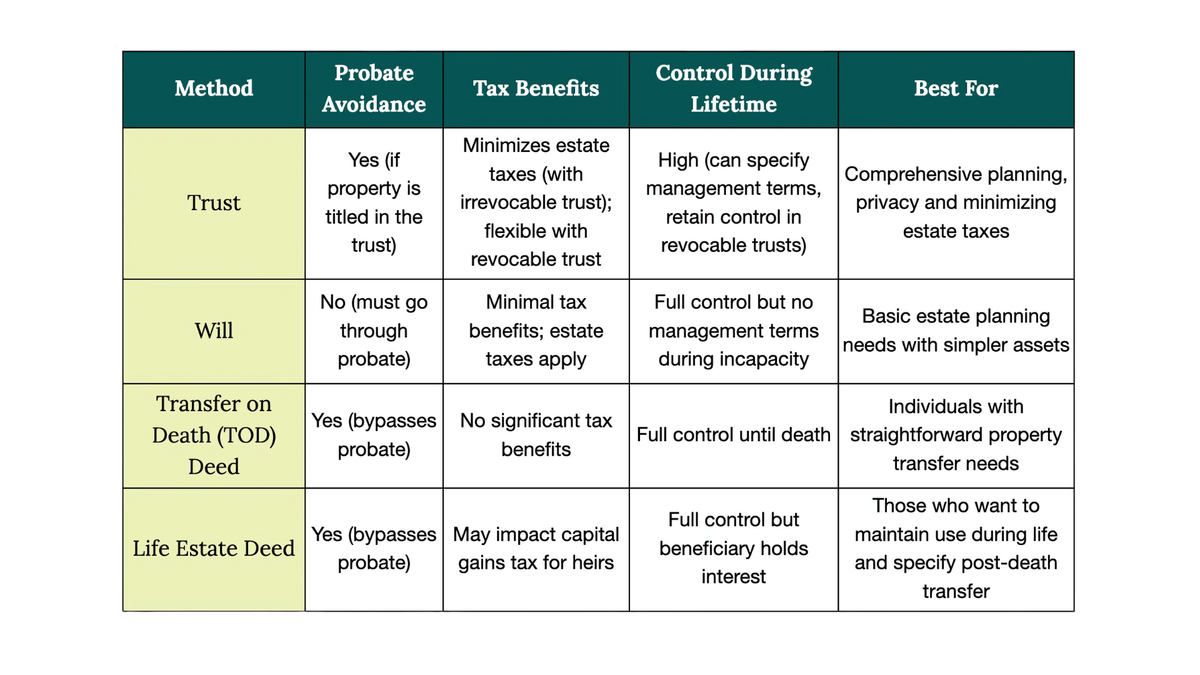

We furthered our industry-leading document creation capabilities last year. This included allowing for greater customizations in our Revocable Trusts and Last Wills & Testaments, such as the ability to add Marital Trusts, Trust for Descendants, name contingent and ultimate beneficiaries in the event no primary beneficiaries are named (also known as a “disaster” clause).

We also refined the client onboarding experience to help them confidently navigate their estate planning journey by simplifying questions asked, providing more educational materials and allowing them to review and confirm their document recommendations.

Awards, announcements & media

Last year, wealth.com made waves in the industry with exciting awards, big partnership announcements and plenty of media buzz.

Announcements

It goes without saying, the most exciting announcement last year was our $30M Series A. The round was led by GV (Google Ventures), along with Citi Ventures, Outpost Ventures, Fifty Three Stations and Firebolt Ventures. It was a pivotal moment for wealth.com and our journey to reimagine estate planning, as well as setting the stage to even bigger in 2025.

We also announced a number of exciting partnerships, including:

Awards

We’re thrilled and grateful for the recognition our product and leadership team received last year. It’s exciting to see industry leaders and peers acknowledge our achievements and the hard work the entire wealth.com team puts in every day to build the best solution.

Here are some highlights from 2024:

In the media

Wealth.com was featured in nearly two hundred media mentions in 2024, including nationally recognized and industry-leading publications such as WealthManagement.com, CityWire RIA, ThinkAdvisor, Axios, Financial Planning, InvestmentNews, Barron’s and more.

We’re continuously engaging reporters to provide education on how advisors can best serve their clients through estate planning strategies. You can find all our latest news on our Press Page.

On the road

If you ran into a wealth.com team member in 2024, it’s no surprise—we were everywhere! From speaking on stages to building connections and handing out fan-favorite swag (shoutout to the lucky surfboard winner at FutureProof 2024), we made the most of nearly two dozen events.

And we’re just getting started. In 2025, we’ll be hitting the road even more, so keep an eye out. We can’t wait to reconnect and meet new faces along the way!

What we’re focused on in 2025

2024 was just the start for wealth.com and we’re building on the momentum for 2025. This year, we’re raising the bar with exciting announcements, feature updates, and more. While we can’t reveal everything just yet, here’s a what you can expect from us:

Continuing to lead the industry in innovation

With the Family Office Suite™, the industry leading AI, and unmatched document creation capabilities, wealth.com stands as the only true end-to-end estate planning solution. This year, we’re doubling down our focus on rolling out features designed to serve all clients, from the UHNW to the mass affluent, helping advisors streamline their businesses and achieve true scale.

This year, you can expect to see us:

- Introducing greater flexibility to customize your clients’ use cases, from document creation to reporting.

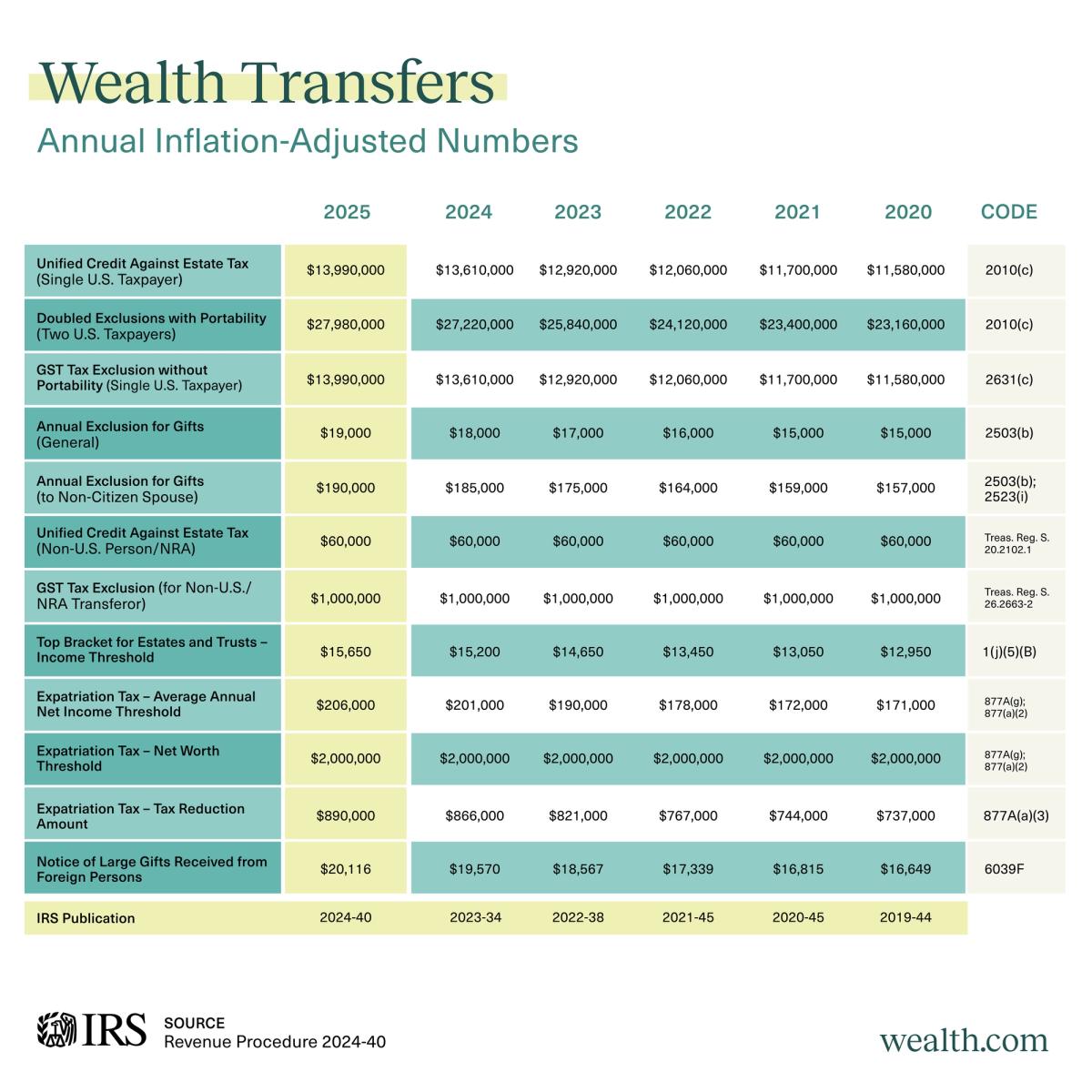

- Expanding your strategic capabilities for estate and tax planning in the platform.

- Adding more integrations to streamline your planning and collaboration processes.

- These are only the tip of the iceberg. We’re making bold moves to innovate and solidify wealth.com as the ultimate estate planning platform for advisors and their clients.

- Empowering advisors with unmatched support and resources

At wealth.com, we’re passionate about helping our advisor partners excel to both maximize the value of our platform and deliver an exceptional client experience. In 2025, we’re focused on expanding educational resources by launching Wealth.com Workshops—an exclusive series of virtual events designed to unlock the full potential of estate planning.

Early pilot sessions showed incredible engagement, and we’re excited to make this a cornerstone of the advisor experience.

We’re committed to making every wealth.com interaction seamless and rewarding. Stay tuned for more exciting updates as we continue to improve the advisor experience.

Harnessing AI to transform estate planning

Ester™ isn’t going anywhere—in fact, it’s just getting started. We believe AI is key to enhancing the wealth.com experience for advisors and the value they bring to their clients. This year, our AI team will be working hard to expand Ester™’s capabilities and integrate AI more deeply across the platform.

Events, events & even more events

It’s a good thing the wealth.com team can’t sit still because they’ll be criss-crossing the country attending all of the hottest wealth management events.

Here’s where we’ll be in the next few months—if you’re there, come say hi!

The best is yet to come

2024 just set the stage for wealth.com, and the importance of estate planning in holistic wealth management. But our focus continues to be on you—the advisor, the wealth manager and your clients. Your success is our reward and we couldn’t have achieved the amazing things in 2024 without our amazing clients and partners. We can’t wait to show you what we’re working on this year and to help you achieve even better results for your clients and your business.