In front of a sold-out in-person audience, with more than 2,000 joining virtually, Wealth.com opened its annual product keynote with insights from Chief Product Officer Danny Lohrfink, SVP of Product Nicole McMullin, and CEO Rafael Loureiro.

As he noted in his opening remarks, we are in the middle of the largest wealth transfer in history, with $124 trillion changing hands. Yet the industry still relies on tools not designed for this moment. Fragmentation creates friction and missed outcomes, preventing planning from compounding and scaling.

To solve this, we unveiled new advisor updates, integrations, and Wealth.com Tax Planning. Here are the top 10 announcements from the EstateCon 2026 Product Keynote.

- Introducing Wealth.com Tax Planning

The headline of the event was the official launch of Wealth.com Tax Planning. Historically, tax and estate planning have lived in separate silos, but we know these decisions are inseparable. This new module unifies them, allowing advisors to model how tax strategies—like exercising options or relocating—directly shape the legacy a client leaves behind.

- A Landmark Integration with Goldman Sachs Custody Solutions

Opening a trust account has traditionally been a tedious process defined by manual data entry. By integrating Wealth.com with Goldman Sachs Custody Solutions (GSCS), advisors can now move from document review to account funding in a single, unified workflow.

Leveraging Ester®, the first AI assistant specifically trained in estate planning, the system automatically extracts key trust details—such as grantors, trustees, and beneficiaries—directly from legal documents to pre-fill account applications. Advisors can open trust accounts, link bank accounts, and initiate ACAT transfers without ever leaving the Wealth.com dashboard.

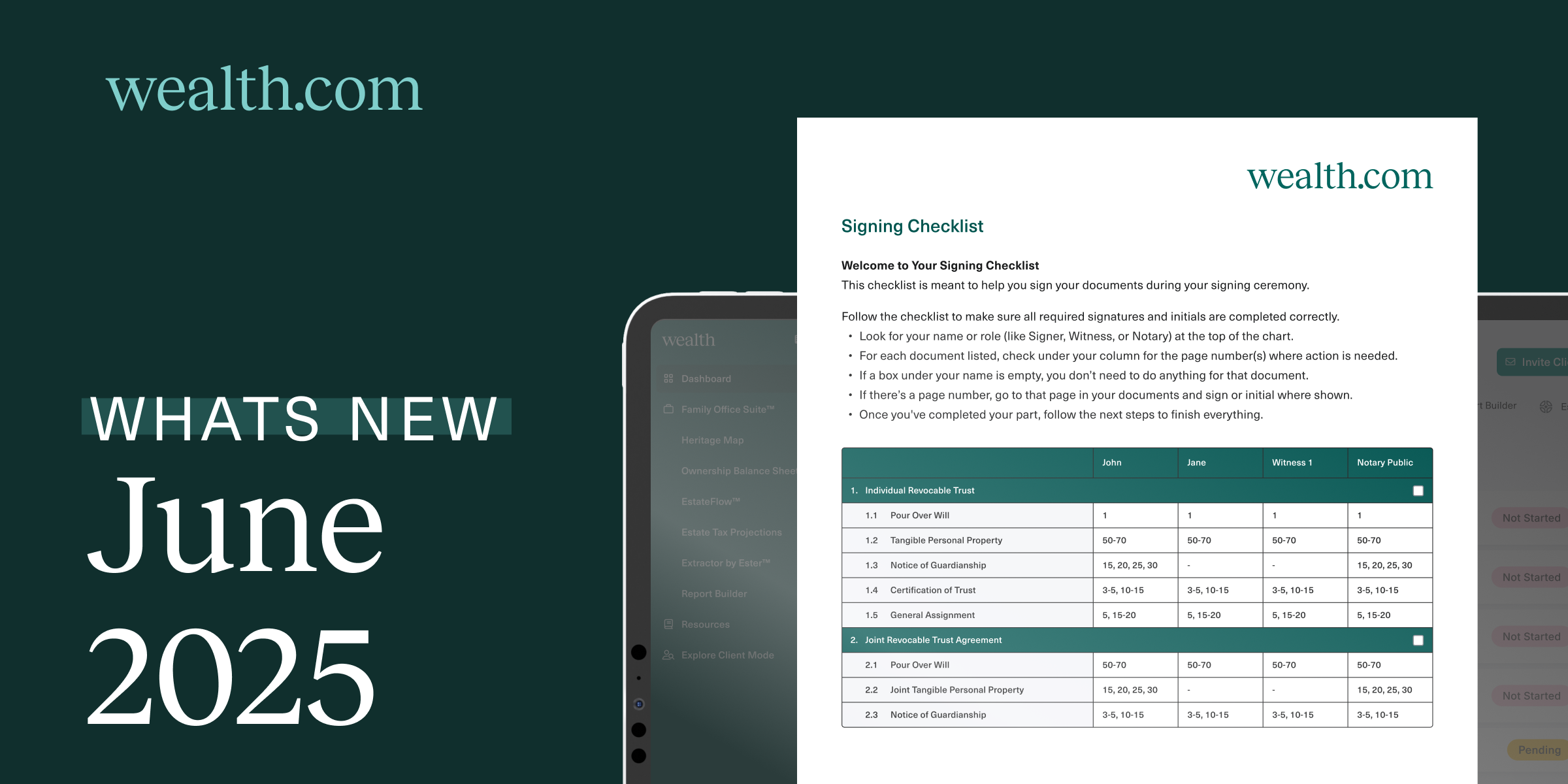

- In-App Deed Preparation

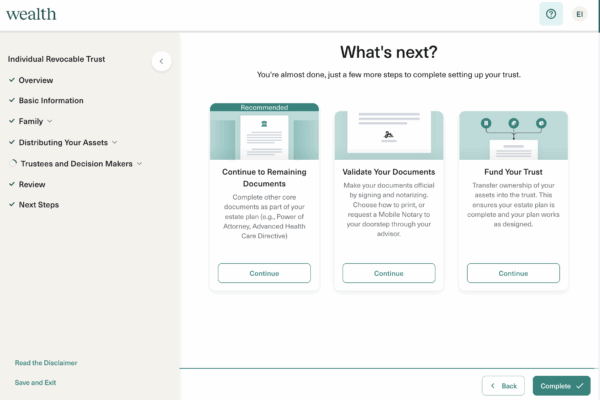

One of the most persistent challenges in estate planning is the funding gap, the period after a trust is created but before assets, especially real estate, are formally transferred into it. Historically, deed transfers required outside attorneys, manual title research, and months of coordination.

To eliminate that friction, we launched In-App Deed Preparation. Clients can now initiate deed transfers directly within their Wealth.com portal and complete the process in days, not months, and with coverage across every county in all fifty U.S. states.

The entire experience is client-led. Clients select their properties, choose their timeline including a 48-hour rush option, schedule a mobile notary at their convenience, submit payment by credit card, and notarize their entire Wealth.com estate plan in one coordinated step.

- Meeting Intelligence: Jump, Zocks, and Zoom AI

Planning shouldn’t start with data entry; it should start with listening. We announced new integrations with Jump, Zocks, and Zoom AI that turn meeting transcripts into actionable data. If a client mentions a liquidity event or a move during a call, that context flows directly into their Wealth.com profile without you having to type a word.

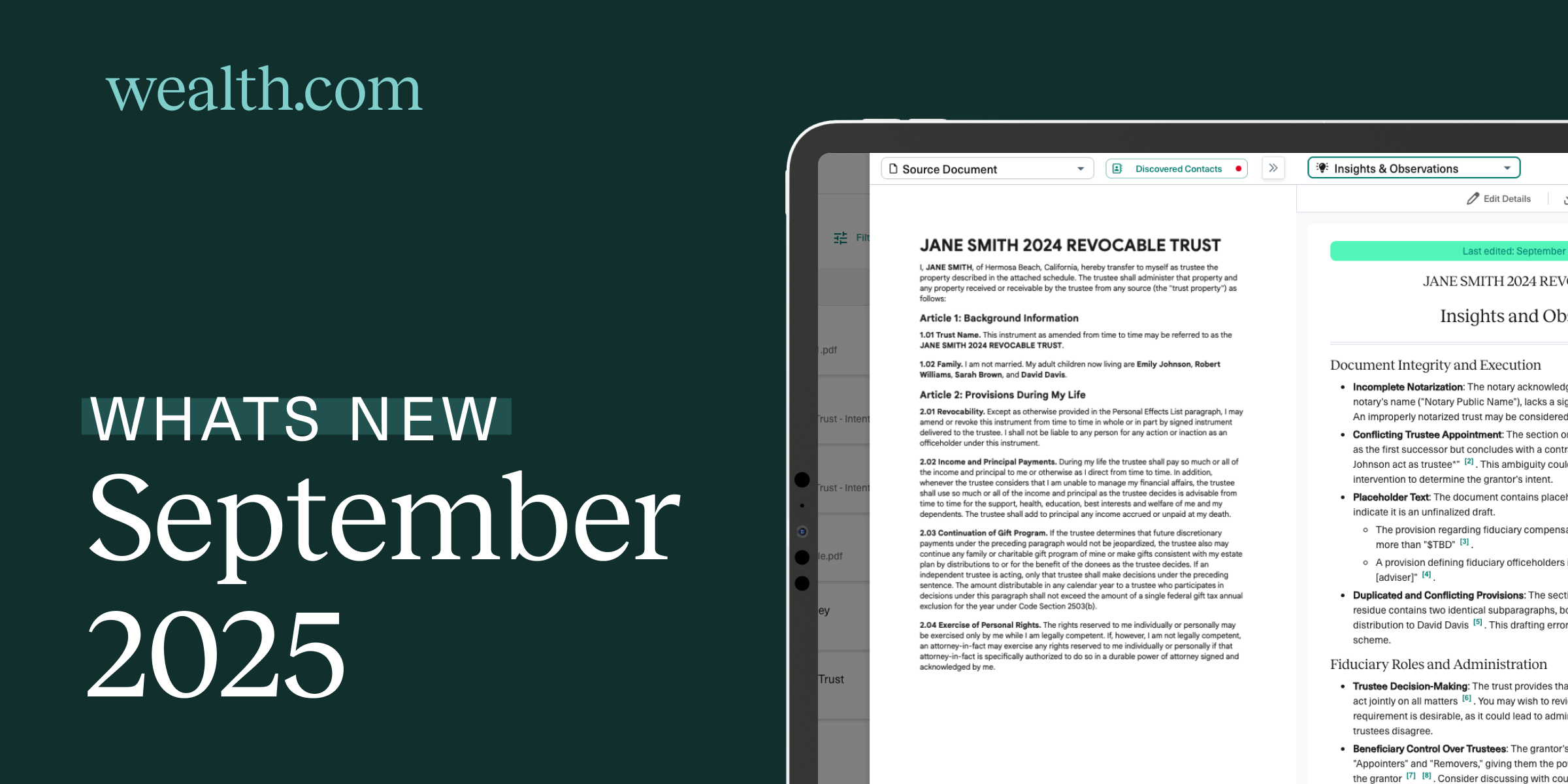

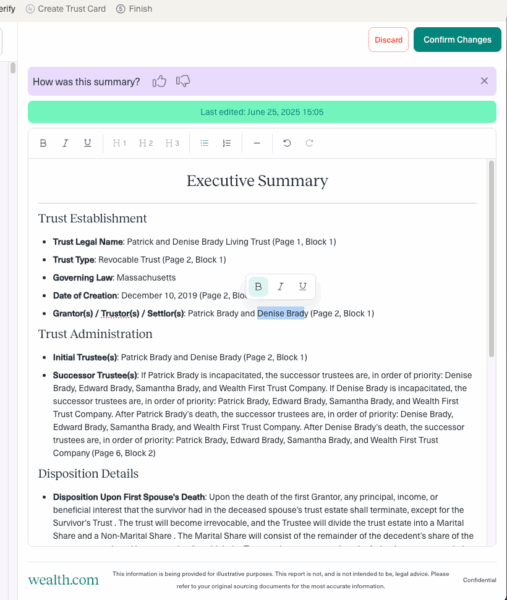

- Ester Becomes Consequence-Aware

Our AI assistant, Ester, has evolved beyond simply extracting information from documents. She now understands consequences, and soon, policy. During the keynote, we showed Ester analyzing a 50-page trust in seconds, flagging real risks such as ambiguous distribution language and potential trustee conflicts. But coming in April, Ester goes a step further.

Advisors will be able to simply ask:

“What if the leading Democratic candidates in New York City were to enact their proposed policies? How would my clients be impacted?”

In seconds, Ester will do what an analyst would normally spend an entire day on. First, she reviews the latest polling data to identify the leading candidates. Next, she researches their proposed legislative agendas, with a focus on personal finance issues such as income and estate taxes. Finally, she analyzes those proposals against the client’s actual circumstances, their real balance sheet and their actual estate plan.

The output is a clear, side-by-side view of how potential policy changes could impact a client’s financial outcomes, translating abstract policy into real dollars and real decisions.

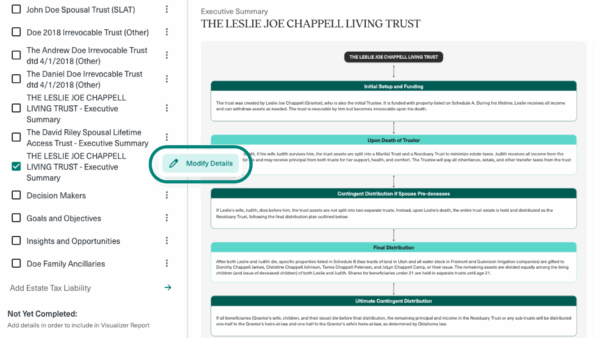

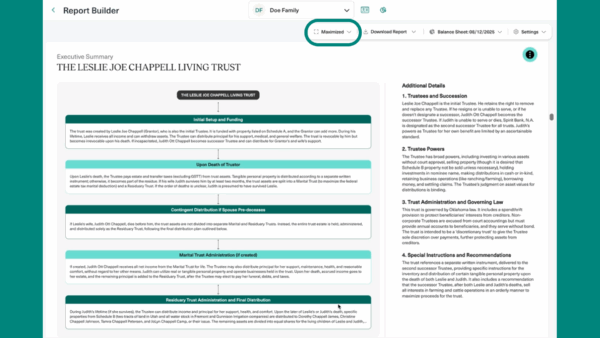

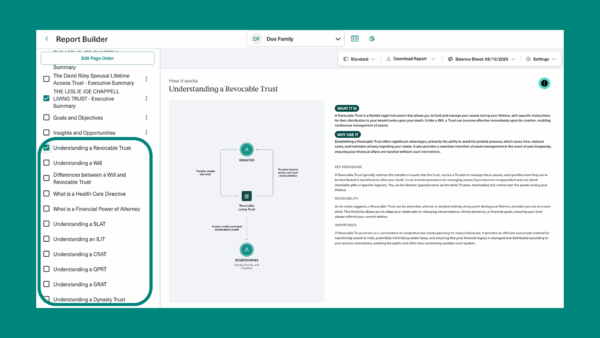

- The New Report Builder & Visual Flowcharts

We have completely rebuilt how estate plans are visualized . The new Report Builder moves away from static PDFs to create living flowcharts. These visuals show exactly how assets move and when trusts activate, ensuring clients truly understand their plan.

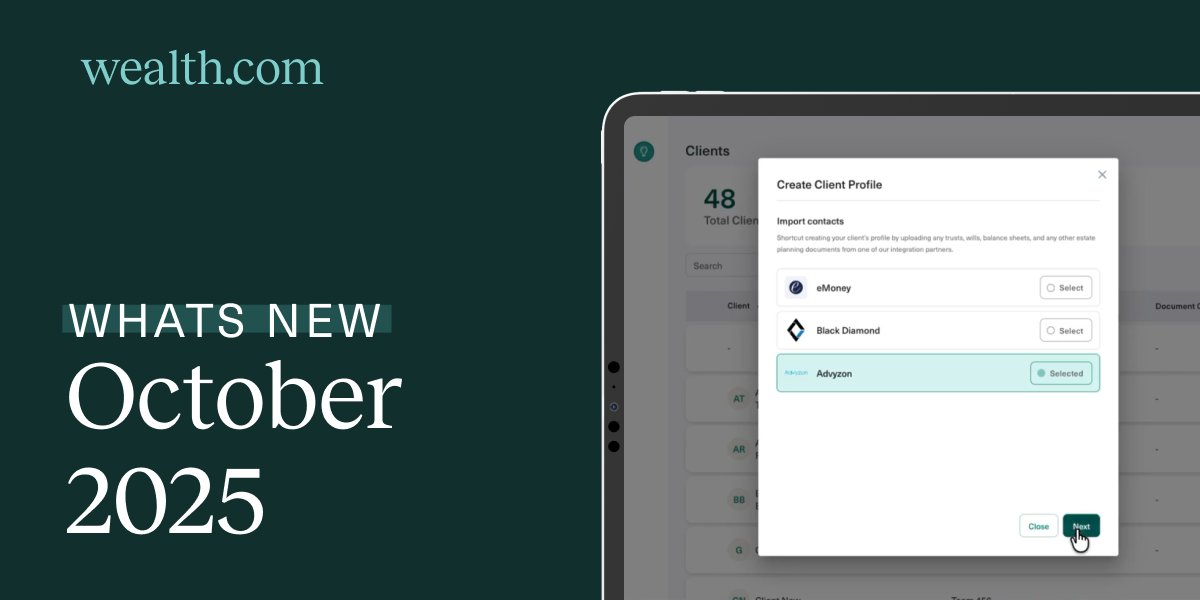

- Integrating Alternatives with Arch

Building on our robust suite of integrations with eMoney, Addepar, and BlackDiamond, we announced an upcoming integration with Arch. This will allow advisors to seamlessly capture hundreds of alternative investments owned by HNW clients and incorporate them directly into the planning process.

- Major milestones in estate planning at scale

Wealth.com announced:

Over 100,000 estate plans completed

Coverage across all 50 states

Average completion time under 30 minutes

94 percent start-to-completion rate

- Side-by-Side Scenario Comparisons

Clients often ask, “What if I moved?” Now, you don’t have to guess. Our new comparison tool lets you run scenarios—like a move from New York to Florida—side-by-side. The system instantly calculates the differences in income tax, estate tax, and family outcomes.

- Compounding Estate Impact Metrics

Finally, we introduced a metric that changes how clients view tax strategy. When you model a decision—like a Roth conversion—Wealth.com now explicitly shows how that choice impacts the estate size decades in the future. It’s the power of compounding, made visible.

The Future is Already Here

As Rafael said in his closing, this isn’t an academic exercise. It’s about giving families certainty and ensuring that fragmentation never gets in the way of compounding. Ready to see these features in action?

Watch the EstateCon Keynote Replay