TL/DR

A Trust is a financial agreement between someone who owns an asset and a trusted person to hold and manage that asset for them. In estate planning, a Revocable Trust is often used as a substitute for a Will, but there are many types of Trusts that accomplish different objectives. If you’re trying to decide whether you should have a Trust in your estate plan, read this two-part article.

__________________________________________________________________

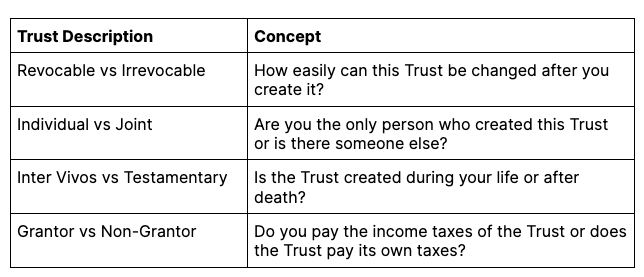

What’s the difference between a Marital Trust and a QTIP Trust? Are Bypass Trusts and Credit Shelter Trusts trying to accomplish the same goals? As you start learning about Trusts, you’ll learn that there are subtle differences between the Trusts that you might include in your foundational estate plan. Adding to the confusion, each lawyer has a different name for Trusts that do pretty much the same thing, and we try to provide the most common names for them.

Choosing to use a Trust in your estate plan is about being clear on your goals for how your assets should go to your loved ones. Trusts are created through a contract, and so there are a million different ways to write a contract to meet your specific goals.

This Article is divided into two parts. Part 1 is a primer on the key differentiators between Trusts. This Part 2 is a summary of the most commonly created Trusts in a foundational estate plan and their benefits.

The trusts named in this article are the ones you are most likely going to encounter when creating your foundational estate plan, which is centered on a Will or Revocable Trust and disposes of your assets when you pass away. This article does not discuss Trusts that you might create during life for wealth transfers or tax planning.

It is also important to realize that the descriptions for these Trusts are not mutually exclusive; you can use multiple adjectives to describe one Trust in your estate plan. For example, you can create a Marital Trust that is also a Spendthrift Trust.

Revocable or Living Trust

This Trust is most often used as an alternative to a Will for disposing of someone’s assets at death. It is also a great vehicle to transition the management of your financial affairs smoothly to someone whom you trust, in case you become incapacitated.

Learn more about Revocable and Irrevocable Trusts in Part 1 of this article.

Marital Trust

The Trust’s creator (“trustor”) creates this irrevocable Trust for the primary benefit of the spouse (i.e., your spouse can enjoy your assets after you have passed away). A Marital Trust is useful for someone who has a blended family, worries about elder abuse of their spouse or someone influencing their spouse to disinherit their beneficiaries, or is wealthy enough to worry about the estate and generation-skipping transfer taxes. There are many ways to design a Marital Trust, but if you also want your spouse’s inheritance to qualify for a benefit called the “unlimited marital deduction” (i.e., you could pass an unlimited amount of property to your spouse completely free of estate tax at your death), the Tax Code has stringent requirements for the design of this Trust (see “QTIP Trust” below).

QTIP Trust

The Qualified Terminable Interest Property Trust is a specific kind of Marital Trust. Its terms are properly structured to comply with the tax rules so that you can pass your property to your spouse in a trust and still benefit from the unlimited marital deduction.

One of the biggest “loopholes” under the estate tax rules is the unlimited marital deduction. This deduction allows you to pass unlimited amounts of property to your spouse (beyond the estate tax exemption of $12.92M in 2023), completely free of the estate tax.*

Not all Marital Trusts comply with these rules. For example, your Marital Trust may say that your spouse will be the only beneficiary for the rest of your spouse’s life, but if your spouse remarries, the Trust will end and your assets will pass to your other loved ones. By inserting the condition about remarriage, your Marital Trust does not comply with the tax rules. Your gift to your spouse counts toward the federal tax exemption, along with any property you pass to other non-charitable beneficiaries, and could lead to an inadvertent foot fault where your estate owes estate taxes.

____

*As with all things tax, there are a lot of factors to unpack in this statement. Importantly, your spouse must be a U.S. citizen. In addition, the federal government only grants this benefit to individuals who are legally married, and not individuals in a domestic partnership, civil union, or other relationship arrangements. The fact that the unlimited marital deduction was not available for individuals in same-sex marriages performed under state law was the basis for the seminal case, U.S. v. Windsor, 570 U.S. 744 (2013). The case declared the federal law, the Defense of Marriage Act, to be unconstitutional and forced the federal government to grant the same government benefits to same-sex spouses. Those government benefits include the estate tax deduction!

Family, Bypass, or Credit Shelter Trust

This Trust goes by many names, but in essence, it is an irrevocable Trust created at your death to allow your family to engage in death tax planning.* If your estate may have a tax issue, this Trust allows your executor or trustee to use what remains of your tax exemption amount ($12.92M in 2023 at the federal level*2) and shelter those assets from future death taxes. This Trust becomes a “family bank,” where assets continue to grow and benefit a family, but no death tax will be imposed with the passing of each generation.

____

*“Death taxes” in this article refers to the estate tax and generation-skipping transfer tax. These two tax regimes exist at the federal and state levels.

*2 The exemption amount may be significantly lower at the state level, and can be as low as $1M.

A/B Trusts

This term applies to estate planning for couples. It describes the most common combination of Trusts that are formed at the death of the first person who passes away: the Marital Trust (“A Trust”) and the Family Trust (“B Trust”). Your estate plan will then specify a mechanism for how your executor, trustee, or even your spouse, can allocate assets between those two Trusts.

As an additional variation on this term, if you and your spouse have a joint Trust (i.e., you created your estate plan together through one Revocable Trust), your estate plan may use A/B/C Trusts. In addition to the Marital and Family Trusts, your estate plan might create a Survivor’s Trust (read more below).

Survivor’s Trust

The Survivor’s Trust is relevant only when a couple creates a joint revocable Trust; it is the continuation of the revocable Trust once one person has passed away. With a joint Trust, the estate plan must describe where all of the couple’s assets will go – not only the deceased person’s assets, but also the survivor’s assets. Because one half of the couple is still living, the Survivor’s Trust exists to collect and hold the survivor’s assets without requiring the survivor to create a brand-new estate plan. The survivor can thus change and revoke the Survivor’s Trust as desired (but a Marital Trust or Family Trust is irrevocable).

Trust for Descendant or Trust for Issue

This type of Trust goes by many names, and often references the name of the primary beneficiary (e.g., Trust for Sara). This irrevocable Trust allows the beneficiary to enjoy the Trust assets, but without the full control that comes with owning assets in their own name. This Trust is useful for designating someone else to manage financial affairs while the beneficiary is not ready or able to handle the responsibility, ensuring that assets stay within a family, protecting an inheritance from divorce or creditors (e.g., the beneficiary’s personal debts), and planning for death taxes.

These Trusts are drafted in many different ways, and can take the form of a Holdback Trust or Special Needs Trust, as appropriate.

Holdback Trust

The primary purpose of this Trust is to “hold back” the inheritance for a younger beneficiary until the beneficiary comes of age. This irrevocable trust is meant to be a temporary vehicle and is more robust than a UTMA account in allowing the trusted person to manage the beneficiary’s finances. Usually, you will be given the opportunity to decide on which birthday the trust will end and the beneficiary should be able to receive all the assets.

Special Needs Trust

This irrevocable Trust is structured with a beneficiary who has long-term special needs in mind. The Trust usually lasts during the life of the beneficiary and preserves the beneficiary’s eligibility for government programs like Medicare. This Trust should have provisions allowing a trusted person to modify the Trust terms to optimize the Trust for the needs of that beneficiary, such as restricting certain powers, or adapting to government rules to access benefits.

Charitable Trust

This irrevocable Trust benefits a charity, and usually is created so that the gifts to the Trust qualify for a charitable deduction for income tax purposes, estate tax purposes, or both.

The second of the biggest “loopholes” in the estate tax rules is that a properly made gift to charities qualifies for an unlimited deduction (see “QTIP Trust” for the other unlimited deduction). To set up a Charitable Trust for tax planning, you must make sure that there are restrictions so that the organization cannot receive a Trust distribution unless it qualifies under the Code (usually, an organization that has maintained its 501(c)(3) status, but the estate tax rules have slight variations).

Pet Trust

This irrevocable Trust benefits pets. You would name someone to take care of the pets and to handle the finances for your pets (which may be the same person or different people). However, Pet Trusts are disfavored under the law. For example, you may be able to benefit only the pets who are alive when you pass away, and not their descendants, and the Trust’s distributions are taxed as income to the caretaker even if they are used to cover the pets’ expenses.

Spendthrift Trust or Asset Protection Trust

This Trust must be properly structured according to state law to grant the layer of protection from legal claims against the beneficiary and the creditor’s state must also respect that result. When the asset protection is respected, the Trust’s assets are considered separate from the personal assets of the beneficiary to satisfy personal claims against the beneficiary. For example, the Trust’s assets may not be considered in alimony calculations upon divorce, or the Trust’s assets cannot be forced out of the Trust to pay the debt or a monetary judgment against the beneficiary. Oftentimes, creating this Trust requires an affirmative statement in the Trust document and giving the trustee full discretion to decide when distributions can be made.

Originally published January 27, 2023, and updated on November 14, 2025.